Current Status and Growth of the Domestic ETF Market

Although the domestic exchange-traded fund (ETF) market has grown rapidly, reaching 270 trillion won, the issuance of new synthetic ETFs has sharply declined. This is due to more stringent regulatory assessments following the Russia-Ukraine war, resulting in higher barriers for synthetic ETF approvals. Industry insiders criticize these regulations for stifling innovation and diversity in financial products.

Meanwhile, the 'ACE NVIDIA Bond Mixed ETF,' which blends NVIDIA stocks with domestic bonds, has seen a significant increase in net asset value. The growth was fueled by expectations surrounding NVIDIA's global AI semiconductor dominance and the resumption of exports to China.

TIMEFOLIO Asset Management's 'TIMEFOLIO Global AI Active ETF' has surpassed 1 trillion won in net assets, establishing a diversified portfolio linked to the AI value chain with stellar returns. The continuous growth of the AI industry keeps investors highly engaged.

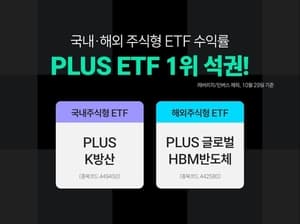

Additionally, Hanwha Asset Management's 'PLUS K-Defense' and 'PLUS Global HBM Semiconductor' ETFs have achieved the highest returns in domestic and international equity-type ETFs, driven by increased defense spending and a surge in AI semiconductor demand. Global geopolitical dynamics and advances in AI technology have greatly contributed to this achievement.

Related ETF

Related News

Hantoo Asset Management's ACE Nvidia Bond Mix Surpasses KRW 250 Billion - meconomynews.comKorea Investment Trust Management announced on the 31st that the net asset value of the ACE Nvidia Bond Mix ETF recorded KRW 254.6 billion as of the 30th. This represents a 75.7% increase compared to the end of last year (KRW 144.9 billion). The growth in net assets is attributed largely to the increased demand for the world's leading artificial intelligence (AI) company, Nvidia's expanded investment in data centers, and expectations surrounding the resumption of exports to China. According to Koscom ETF CHECK, funds inflows into this ETF since the beginning of the year have reached KRW 77.9 billion. The ACE Nvidia Bond Mix combines Nvidia stocks with domestic bonds to mitigate volatility.

Hanwha Asset Management Achieves Top Returns in Domestic and International Defense and HBM ETFs - News Pim[Seoul = News Pim] Reporter Kim Ga-hee: Hanwha Asset Management announced on the 31st that its 'PLUS K Defense' ETF and 'PLUS Global HBM Semiconductor' ETF each achieved the highest return among domestic and international stock ETFs. According to financial information company FnGuide, as of the 29th, PLUS K Defense ETF

Related ETF

TIMEFOLIO Asset Management Achieves 1 Trillion Won in 'TIMEFOLIO Global AI Active' ETF - NewsPim[Seoul=NewsPim] Reporter Kim Ga-hee = TIMEFOLIO Asset Management announced on the 31st that the net asset value of its 'TIMEFOLIO Global AI Active' exchange-traded fund (ETF) has exceeded 1 trillion won. The TIMEFOLIO Global AI Active, which was listed on May 16, 2023, is...

Hanwha Asset Management Dominates with K-Defense and Global Semiconductor ETFs as Top Performer - Yonhap InfomaxThis year, the highest-performing investment option among domestic and foreign equity ETFs was found to be in defense and global semiconductors. On the 31st, Hanwha Asset Management announced that as of the 29th, the 'PLUS K-Defense' ETF recorded a 210.27% return since the beginning of the year, ranking first among domestic equity ETFs. The 'PLUS K-Defense' ETF is a product investing in the domestic defense industry. Recently, amid geopolitical tensions and the confrontation between the U.S.-centered Western forces and the China-centered anti-Western forces, the demand for defense has surged, boosting returns. In fact, Hanwha Systems and Hanwha Aerospace,

Related ETF

Hanwha, PLUS ETF 'Defense Industry·HBM' Double Lead... No. 1 in Domestic and Overseas Returns - ETodayHanwha Asset Management has simultaneously topped domestic and overseas returns with ETFs themed on defense and HBM (High Bandwidth Memory). Global geopolitical risks and AI (artificial intelligence) semiconductor investments.

Related ETF

TIMEFOLIO Asset Management's 'Global AI Active' ETF Surpasses 1 Trillion KRW in Net Assets - EdailyTIMEFOLIO Asset Management announced that their prominent active ETF, focusing on the AI value chain in South Korea, 'TIMEFOLIO Global AI Active' ETF, has surpassed 1 trillion KRW in total net assets (AUM). This ETF actively invests across the entire global AI value chain, including generative AI...

'Regulations from the Russia-Ukraine war era still persist'...Synthetic ETFs, industry 'discontent' over implicit restraint'Regulations from the Russia-Ukraine war era still persist'...Synthetic ETFs, industry 'discontent' over implicit restraint-Invest Chosun