Key Trends in ETF Dividends and Gold

Korean asset management firms are unveiling expected dividend payments for their monthly-reward ETFs as November approaches. Mirae Asset Management has announced expectations for its eight TIGER ETFs, offering varying dividend rates, with the TIGER US AI Big Tech 10 Target Daily Covered Call ETF showing the highest rate. Similarly, Samsung Asset Management has disclosed dividends for 16 of its KODEX ETFs, attracting investor attention. These ETFs aim to maximize returns through diverse dividend strategies.

Hanwha Asset Management has released its dividend plans for four PLUS ETFs, highlighting noteworthy dividend rates. In particular, the PLUS High-Dividend Weekly Fixed Covered Call is anticipated to offer an annual dividend of 12%, aiming for high returns through various strategies.

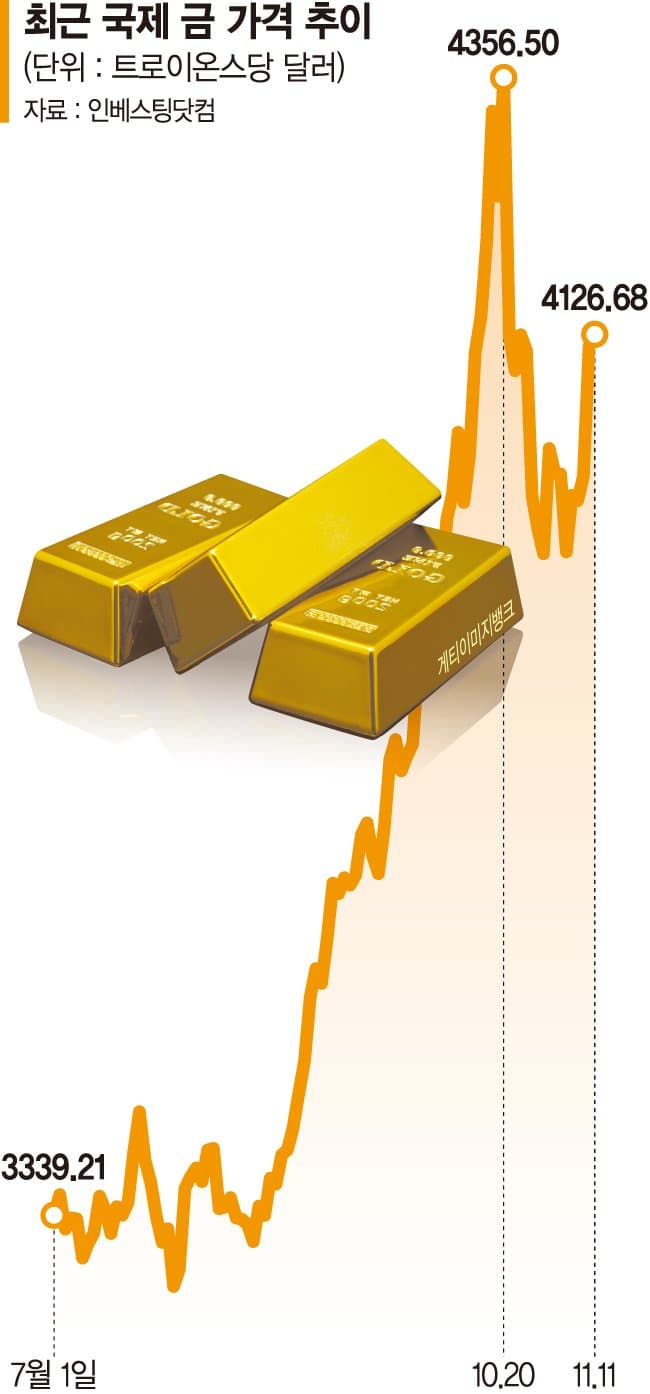

In the gold market, positive movements have been observed with gold prices climbing 4.9% within a week. Around 100 billion KRW has flowed into the ETF market, especially into the 'ACE KRX Gold Spot'. Expectations of an interest rate cut have positioned the gold price for further upward movement. UBS recommends gold as a long-term strategic asset in portfolios, urging investors to maintain steady interest.

Related ETF

Related News

"Gold Rally Again"… Mass Inflow of Money into Gold ETFs - Financial NewsAs gold prices, which had stalled, re-enter the upward trajectory, a mass inflow of money is heading into related investment products. Experts believe that although gold prices have recently experienced increased volatility, the long-term upward trend is likely to continue. According to the investment journal Barron's, UBS stated in an analysis note on the 10th that gold prices might next year or 202..

Related ETF

[Table] Hanwha Asset Management PLUS Monthly Dividend ETF November Dividend Details - Smart Today|Smart Today=Reporter Kim Se-hyung| Hanwha Asset Management announced on the 12th the expected November dividend details for four types of PLUS Monthly Dividend ETFs. Dividends can be received for purchases made by the 12th. The dividends will be paid on the 18th. Each share of the PLUS High Dividend Yield and Covered Call ETF offers a dividend of 150 KRW. The payout rate is 1.25%, annualized at 12%.

[Table] Korea Investment Management: November Dividend Details of ACE Monthly Dividend ETFs - SmartToday|SmartToday = Reporter Kim Se-hyung| Korea Investment Management announced on the 12th the expected November dividend details for four types of ACE Monthly Dividend ETFs. Dividends can be received for purchases made up to the 12th. Payouts will be made on the 18th. The ACE US Dividend Dow Jones pays 21 won per unit. The distribution rate is 0.17%. ACE US BigTech 7+ index

Related ETF

[Table] Mirae Asset Global Investments TIGER Monthly Dividend ETF November Distribution Details - Smart Today|Smart Today=Reporter Kim Se-hyung| Mirae Asset Global Investments announced on the 12th the expected November distribution details for 8 types of TIGER Monthly Dividend ETFs. Dividends will be paid for purchases made up to the 12th. The payment will be made on the 18th. The TIGER US AI Big Tech 10 Target Daily Covered Call will distribute 158 won per unit. Based on the closing price on the 11th

Related ETF

[Table] Samsung Asset Management KODEX Mid-Month Dividend ETF November Dividend Details - Smart Today|Smart Today = Reporter Kim Se-hyeong| Samsung Asset Management announced on the 12th the expected November dividend details for 16 types of KODEX mid-month dividend ETFs. The mid-month dividend for November can be received until the 12th for purchases made by the 14th. Dividends will be paid on the 18th. Among Samsung Asset Management's mid-month dividend ETFs, the dividend rate is the highest

Related ETF