New ETF Launch Focuses on U.S. Natural Gas Industry

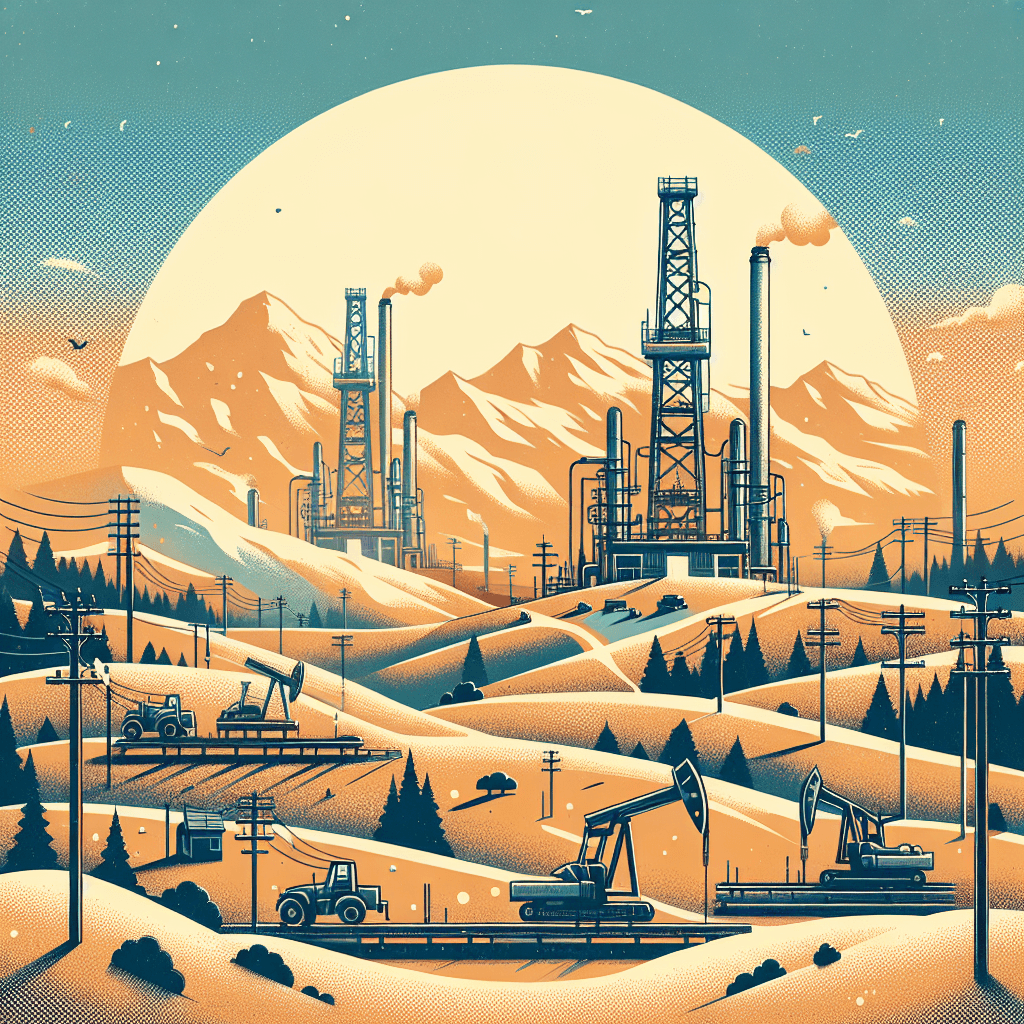

KB Asset Management has launched the 'RISE U.S. Natural Gas Value Chain ETF' on October 22, enabling investments across the entire U.S. natural gas industry. This thematic ETF tracks the Solactive US Natural Gas Value Chain Index and diversifies investments across 15 companies. The investment portfolio is structured into production (30%), infrastructure (50%), and export (20%), with major holdings including ExxonMobil, Enbridge, and Chevron.

The ETF aims to provide comprehensive exposure to the natural gas value chain, allowing investors to achieve balanced investments within various sectors of the natural gas industry. This could serve as an ideal alternative for investors aiming for diversification and stability in their portfolios. Additionally, as the U.S. energy sector continues to hold significant importance, it is expected to draw the attention of global investors looking to invest in related industries.

Related News

KB Asset Management Launches ETF Investing in the U.S. Natural Gas Industry Front and Back - Yonhap InfomaxKB Asset Management is launching a thematic exchange-traded fund (ETF) that diversely invests in the U.S. natural gas industry, the world's largest producer and exporter of natural gas. On the 22nd, KB Management announced the launch of the 'RISE U.S. Natural Gas Value Chain ETF,' which invests in core companies throughout the value chain of U.S. natural gas from production to transportation, liquefaction, and export. Recently, natural gas has been spotlighted as a 'bridge energy source' that serves as an intermediary during the transition to green energy. As a pillar of the energy mix, there has been a recent increase in exports to Europe and Asia, natural gas liquefaction (LNG) infrastructure.

Investment in Next-Generation Energy Sources: RISE U.S. Natural Gas Value Chain ETF Launched - Money TodayKB Asset Management announced on the 22nd that it will launch a thematic ETF (Exchange Traded Fund) that invests across the U.S. natural gas industry. The RISE U.S. Natural Gas Value Chain ETF is a product that invests in key companies within the natural gas value chain, including production, transportation, liquefaction, and export. Natural gas is considered a transitional energy source (Bridge Energy) that plays a bridging role in the shift towards eco-friendly energy....

KB Asset Management Launches 'RISE US Natural Gas Value Chain ETF' - Financial NewsKB Asset Management has announced the launch on the 22nd of a theme-based Exchange Traded Fund (ETF) that invests in the entire natural gas industry of the United States, the world's largest producer and exporter of natural gas. The 'RISE US Natural Gas Value Chain ETF' being introduced involves production, transportation, liquefaction, and export of the natural gas value chain...

KB Asset Management Launches 'RISE US Natural Gas Value Chain ETF' - Smart Today|Smart Today = Reporter Kim Se-hyung| KB Asset Management (CEO Kim Young-sung) launched a thematic exchange-traded fund (ETF) on the 22nd that invests in the entire natural gas industry of the United States, the world's largest producer and exporter of natural gas. The 'RISE US Natural Gas Value Chain ETF' being introduced is focused on the production, transportation, liquefaction, and export of natural gas.