Battery ETFs Gain Attention Amidst Robotics Industry Boom

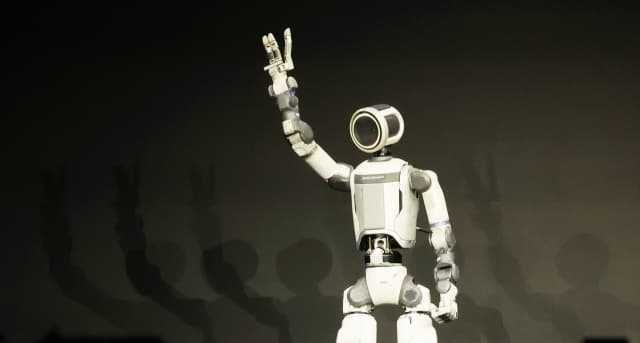

As the robotics industry progresses, battery-related ETFs are receiving renewed attention. Over the past week, ETFs related to solid-state batteries and secondary cells have recorded high returns. This trend is attributed to the increased demand for next-generation battery technologies stemming from the anticipated spread of humanoid robots at CES 2026.

However, the demand for secondary cells within the robotics sector remains nascent, expected to account for only a minute fraction of the total demand by 2030. Notably, ETFs associated with Hyundai have also appeared at the top of the performance charts, suggesting Hyundai's growing influence in the robotics market.

In contrast, despite the stagnation in the electric vehicle market, which previously led to diminished interest in battery stocks, these stocks are now returning to prominence courtesy of the robotics industry. The SOL Solid-State Battery & Silicon Anode ETF, for example, posted an impressive 31.5% return, with various battery ETFs exhibiting strong performance.

Related ETF

Related News

Battery ETF, once depleted in the chasm, is 'fully charged' with a robot engine [Kojubu]Securities > General securities news: Battery stocks, once shunned by investors due to a sluggish electric vehicle market, are gaining traction again in the ETF market thanks to the booming robotics industry...

Electric Vehicle Battery Revived by Beneficial ETF… Comeback with Robotics Engine - SBS Biz[Provided by Hyundai Group=Yonhap News] Once overlooked by investors due to the sluggish electric vehicle market, battery stocks are gaining prominence in the ETF market, benefiting from the robotics industry. According to Koscom ETF Check on the 23rd, ETFs including the battery sector have recently dominated the top tiers of returns over the past week. Secondary battery value chain (value…

Related ETF