ETF Market Trends: From Quantum Computing to Global AI

Recently, ETFs focusing on quantum computing experienced significant declines. According to the Korea Exchange, SOL U.S. Quantum Computing TOP10, PLUS U.S. Quantum Computing TOP10, and KIWOOM U.S. Quantum Computing ETFs recorded losses exceeding 10%. This downturn is further exacerbated by IonQ's large equity financing plan, anticipated to result in financial distress for investors in quantum computing stocks.

Meanwhile, Samsung Active Asset Management's 'KoAct Global AI & Robot Active' ETF surpassed 100 billion KRW in net assets, showcasing impressive performance. The ETF achieved a cumulative return of 98.7% since its IPO, attributed to successful investments in AI power infrastructure companies like Bloom Energy and Centrus Energy.

Shinhan Asset Management is set to launch the 'SOL U.S. Next Tech TOP10 Active ETF,' focused on U.S. tech stocks. The ETF targets sectors such as aerospace, biotech, and AI, including stocks with high valuations. Specifically, Rocket Lab and Cloudflare display high price-to-sales ratios, indicating potential volatility concerns.

Finally, Timefolio Asset Management is launching the 'TIMEFOLIO Global Top Pick Active ETF.' The fund adopts a momentum-based investment strategy aligned with global trends, aiming to avoid sector and regional concentration. It targets strong performance in rising markets while providing effective defense in volatile conditions.

Related ETF

Related News

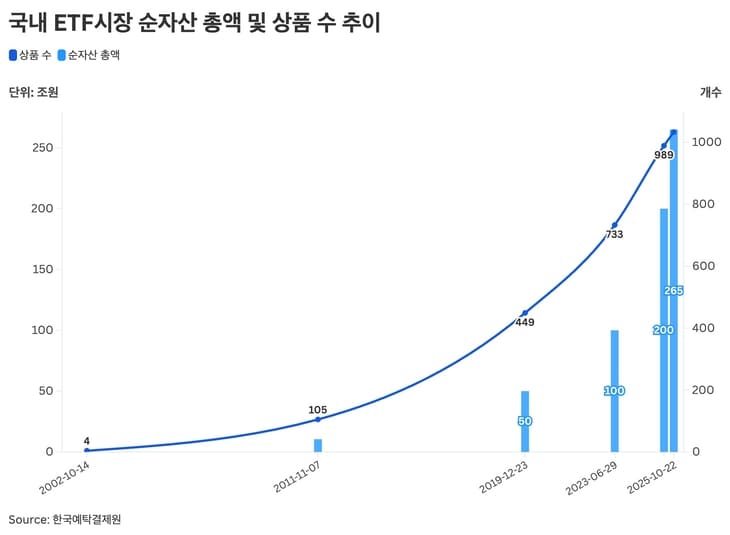

Busy Stock Industry with Market Rise... Asset Managers Rushing to List K-ETFsBusy Stock Industry with Market Rise as Asset Managers Rush to List K-ETFs Amidst the recent continuous rise of the KOSPI surpassing the 3800 mark, asset managers who primarily focused on US-related products in the first half of the year are now competing to launch ETFs related to Korean stocks. Domestic and international investors interested in the Korean market

[Issue+] With 1,000 ETF products, market trends are AI and dividends… Copying practices remain - Energy Economics News MobileSince the inauguration of the Lee Jae-myung government, the ETF market has been focusing on artificial intelligence (AI) and dividend themes. The government's stock market stimulation policy and emphasis on shareholder returns, along with the widespread adoption of AI in the industry...

From 'Heaven to Hell' in a Week…30% Plunge Leaves Retail Investors in Tears - Korea Economic DailyFrom No.1 in Returns to No.1 in Losses in Just a Week...Quantum Computing ETF Plummets Swiftly, Reporter Yang Ji-yoon, Securities

Related ETF

'TIMEOFLIO Global Top Pick Active ETF' to be listed on the 28th..."Optimized for pension asset management" - Financial NewsTIMEFOLIO Asset Management announced on the 22nd that it will list the 'TIMEFOLIO Global Top Pick Active ETF' on the 28th. As a result, it aims for an asymmetric performance curve that "performs stronger in rising markets and more subdued in correction markets." Bae Hyun-joo, a manager at TIMEFOLIO Asset Management, stated, "The more complex pensions are, the higher the chances of failure..."

Samsung Active Asset Management's 'KoAct Global AI & Robot Active ETF' Surpasses 100 Billion Won in Net AssetsSamsung Active Asset Management announced on the 22nd that the 'KoAct Global AI & Robot Active' ETF has surpassed 100 billion won in net assets. KoAct Global AI & Robot Active selects key companies in each developmental stage of the AI industry, including AI infrastructure, services, and robotics, adapting to technology trends and changes in leading companies...

Related ETF

TIMEFOLIO Asset Management Launches 'TIMEFOLIO Global Top Pick Active' ETF - Chosun IlboTIMEFOLIO Asset Management announces the listing of the TIMEFOLIO Global Top Pick Active ETF on the 28th of this month. The company stated on the 22nd that this ETF will be listed, selecting from the most robust global asset classes and thousands of ETFs currently available.

SOL ETF Betting on 'Crazy Growth Stocks'... A Dangerous Balancing Act of Popularity and Downside Risk [ETF Launch] - Smart TodaySmart Today = Reporter Lee Tae-yoon | Shinhan Asset Management is drawing market attention by announcing the launch of an ETF comprised of popular growth stocks not included in the US S&P500. While high popularity among investors is expected, concerns are also raised due to the inclusion of many highly volatile companies. The official name of the ETF is 'SOL America Next.