Growth in Korea's ETF Market and Shinhan Bank's Retirement Pension Success

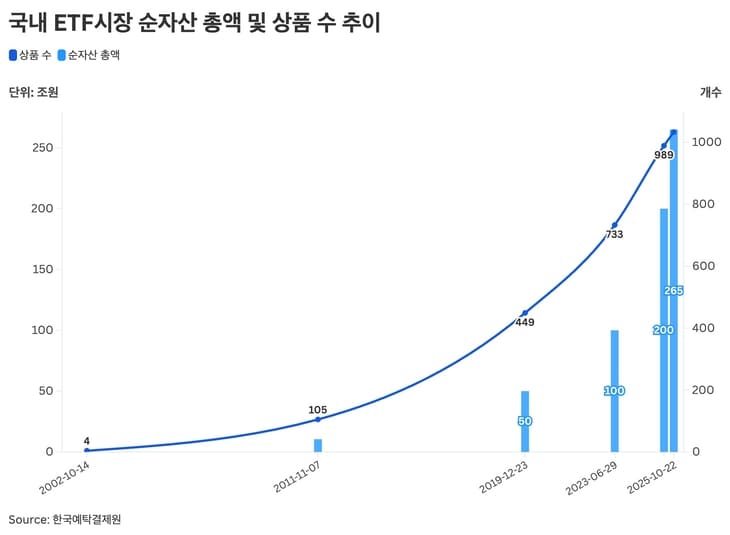

Since the inauguration of the Lee Jae-myung administration, Korea's ETF market has gained considerable attention, prominently featuring themes of AI and dividends. Korea’s ETF market has grown to exceed 265 trillion won, a development closely tied to the increase in theme-based ETFs benefiting from government policies. AI-related ETFs are witnessing heightened activity, spurred by government-led initiatives like 'Sovereign AI'. However, the industry faces criticism over alleged 'copycat' products, prompting calls for introspection.

Shinhan Bank has become the leader in South Korea's financial sector in terms of Individual Retirement Pension (IRP) deposits, surpassing 18 trillion won. This achievement has been driven by the expansion of ETF products and aggressive sales strategies. Additionally, Shinhan Bank plans to offer fee waivers for new IRP customers signing up via non-face-to-face channels, reflecting an ongoing commitment to enhance customer convenience. Such strategies positively influence the growth in IRP deposits.

Related News

[Issue+] With 1,000 ETF products, market trends are AI and dividends… Copying practices remain - Energy Economics News MobileSince the inauguration of the Lee Jae-myung government, the ETF market has been focusing on artificial intelligence (AI) and dividend themes. The government's stock market stimulation policy and emphasis on shareholder returns, along with the widespread adoption of AI in the industry...

Shinhan Bank Surpasses 18 Trillion Won in IRP Reserves... Ranks First in Finance SectorShinhan Bank Surpasses 18 Trillion Won in IRP Reserves... Ranks First in Finance Sector; Increased by Over 13 Trillion Won in 5 Years as ETF Product Expansion Strategy Proves Effective; Fee Waiver Threshold Also Lowered