Surge in ETF Performance Driven by Increased Demand for Gold

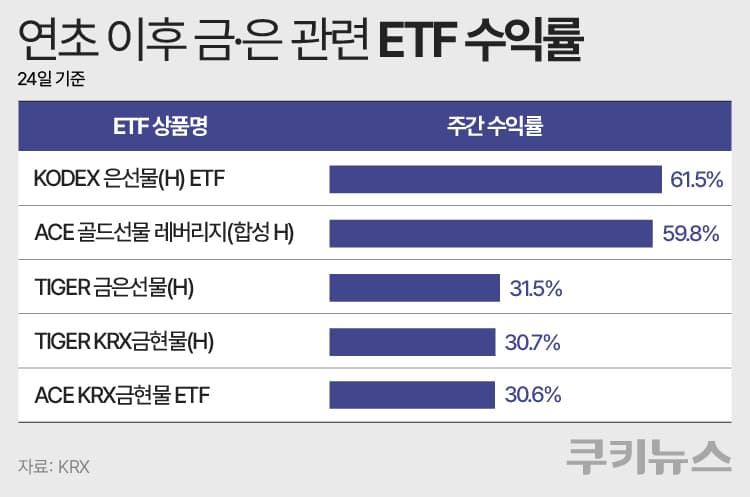

Recently, gold and silver prices have been reaching unprecedented highs, leading to a rise in home installations of small safes, with substantial capital flowing into gold and silver-related ETFs. Particularly, KODEX Silver Futures (H) and ACE Gold Futures Leverage (Synthetic H) achieved returns of 61.5% and 59.8%, respectively, in the past month, capturing investors' interest. Industry experts suggest gold could exceed $5,000 per ounce, further bolstered by increased demand for portfolio diversification and gold as a safe-haven asset.

Meanwhile, Hanwha Asset Management's 'PLUS Gold Bond Mixed' ETF has surpassed 104.2 billion won in net assets due to growing demand for gold investment within retirement pension accounts, an achievement made within about a month. This ETF is classified as a low-risk asset, investing 50% each in gold and three-year government bonds. The rise in gold prices, along with increased demand for safe assets amid global geopolitical tensions, underpins this investment trend. Gold-related investment products are drawing significant attention from retirement account investors, with the PLUS Gold Bond Mixed ETF standing out as the only product in the country allowing 100% gold investment.

Related ETF

Related News

PLUS Gold Bond Mixture ETF, Surpasses 100 Billion KRW in Net Assets - Hans EconomyHans Economy = Reporter Kim Yujin | Hanwha Asset Management announced on the 30th that its 'PLUS Gold Bond Mixture' ETF (Exchange Traded Fund) has surpassed 100 billion KRW in net assets. This is about a month after its listing on December 16 of last year. This surge is attributed to the sharply increased demand for gold investment within retirement pension accounts (DC, IRP). PLUS Gold Bond Mixture is the only gold ETF in Korea that can be fully invested in retirement pension accounts. It invests 50% each in gold and 3-year treasury bonds, classifying it as a non-risk asset according to regulations. By utilizing this ETF, the gold inclusion ratio within retirement pension accounts can be increased up to 85%.

Hanwha Asset Management 'PLUS Gold Bond Mixed' ETF surpasses 100 billion KRW in net assets - Metro NewspaperInvestor interest is surging in the 'PLUS Gold Bond Mixed' Exchange-Traded Fund (ETF), which allows 100% investment from retirement pension accounts. Hanwha Asset Management announced on the 30th that its 'PLUS Gold Bond Mixed' ETF has surpassed 104.2 billion KRW in net assets. This milestone was achieved just over a month after its listing on December 16 of last year.

Hanwha's 'PLUS Gold Bond Mix' ETF Surpasses 100 Billion Won in Net Assets within a Month of Listing - Financial NewsHanwha Asset Management announced on the 30th that the 'PLUS Gold Bond Mix' ETF has achieved a total net asset value of 104.2 billion won. For example, by investing up to 70% of the risk asset limit in the 'PLUS US S&P500' ETF and the remaining 30% in the 'PLUS Gold Bond Mix' ETF, you can achieve a composition of 70% stocks, 15% gold, and 15% bonds.

Bought a Safe Due to the Surge... 'Skyrocketing' Gold and Silver, Even ETFs Heating Up - Cookie NewsI recently bought a safe at home. With gold and silver prices soaring like this, I can't just leave them in the closet. Including the jewelry given by in-laws at the wedding and the baby's first birthday ring.

Related ETF