Surging Silver Prices Drive ETF Investment Opportunities

The recent surge in silver prices has attracted considerable investor interest towards related exchange-traded funds (ETFs). Specifically, KODEX Silver Futures (H) ETF has seen its net assets reach 1.2155 trillion won, doubling in a month. This growth is attributed to silver's dual demand both as a precious metal and industrial material, bolstered by the rising needs of the electric vehicle and semiconductor sectors. Experts evaluate silver as an appealing asset for long-term allocation and recommend investors to consider incorporating it into their portfolios.

Silver’s value is not only due to its status as a precious metal, but also its industrial significance, enhancing its appeal. This presents a strategy for future industrial growth and economic recovery. The influx of investment into ETFs reflects investor expectations and signifies silver's potential role in long-term strategic investment portfolios.

Related ETF

Related News

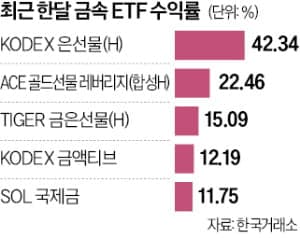

Silver ETF Attracts Massive Funds, Joins the '1 Trillion Won Club' InstantlyWith a surge of investments, the Silver ETF quickly enters the 1 Trillion Won Club. KODEX Silver Futures reached a net asset of 1.2 trillion. As silver prices soar, monthly returns surpass 42%. It's advised to utilize as a long-term asset allocation tool.

Related ETF

Surpassing 1 Trillion Instantly...Silver ETF Rises Higher Than Gold LeverageSurpassing 1 trillion instantly...Silver ETF rises higher than gold leverage, by Yang Ji-yoon, Securities

Related ETF