Securities-themed ETFs Achieve High Returns Amid KOSPI Increase

With the recent increase in the KOSPI index, there has been a noteworthy rise in returns for securities-themed ETFs. Leading securities firms have seen a surge in net profits due to the KOSPI rise, drawing attention from many economic experts. Additionally, the compulsory buyback and cancellation of own shares due to the third amendment of the Commercial Act are further boosting the value of securities stocks. Experts anticipate this trend to continue.

Domestic securities-themed ETFs have stood out in the market with their high returns. Samsung Asset Management's and NH-Amundi Asset Management's ETFs recorded a growth rate of 21.70%, showing strong performance, while the securities sector overall soared by 24.66%. This overall upward trend is fueled by funds flowing into AI semiconductor and robotics sectors. In contrast, overseas equity funds showed a disappointing average return of -0.43%.

Securities-related ETFs have been on the rise due to a surge in trading volumes. The KRX Securities Index rose significantly, with top securities-related ETFs also posting high returns. Several securities firms have seen their stock prices more than double compared to the beginning of the year, suggesting a potential re-evaluation of the whole sector. Despite the bullish phase, investors are cautioned to approach with care due to the potential for increased volatility.

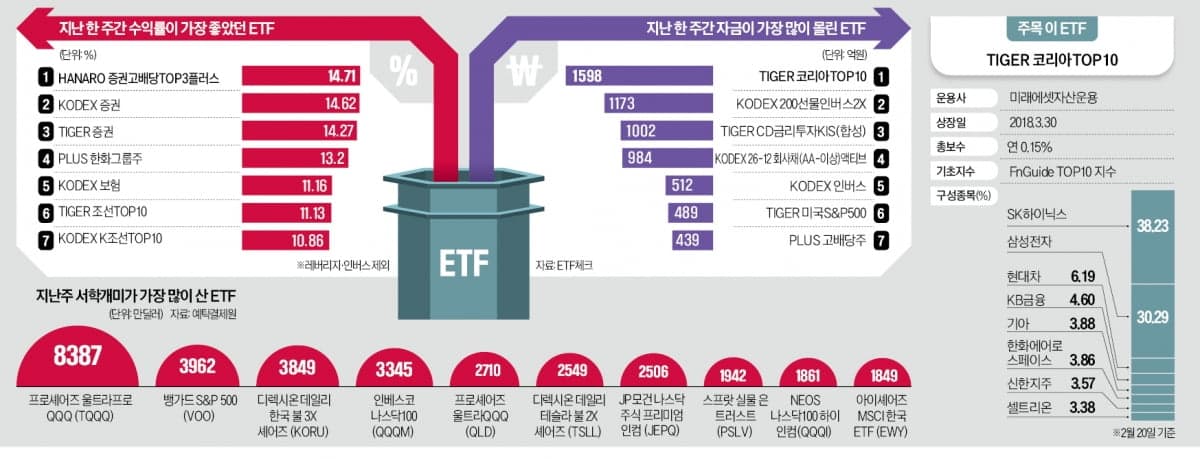

Weekly ETF yields focused on securities stocks have also shown strength. The 'HANARO Securities High Dividend' ETF displayed the most prominent performance with a weekly return of 14.71%, characterized by its focus on major securities firms. Furthermore, shipbuilding-related ETFs, buoyed by the announcement of the U.S. Marine Action Plan, also surged. ETFs focusing on investments in large-cap stocks and betting against market declines have also distinguished themselves regarding net inflows.

Related ETF

Related News

Strong Performance and Shareholder Returns Expected… Soaring Securities ETFStrong performance and shareholder returns expected… Securities ETF soaring, weekly ETF returns HANARO Securities High Dividend 1-week return of 14.7%, rising trend in Shipbuilding ETF, leveraged inverse ETF ranks second in net buying

Related ETF

Securities ETFs Soar in Bull Market…Yield Doubles in Two Months - E-TodayTrading volume surpasses 62 trillion won…Brokerage performance improvement expected. Record-high deposits and margin loan balances…Industry revaluation in a liquidity-driven market. Share buyback and commercial code amendment momentum…Escape undervaluation

Anticipation for Commercial Code Revision and Low PBR Normalization 'Sweep' Weekly Earnings of 'Securities ETF' [Fund Watch] - edaily.co.krIn the domestic exchange-traded fund (ETF) market, securities-themed products dominated the top ranks in weekly returns. The anticipation of commercial code revisions, including the government's move to mandate the destruction of treasury shares, has spread across the entire low PBR sector causing a surge in the securities industry, with related ETFs dominating the top ranks. Shipbuilding and KOSDAQ leverage products also...

Securities ETF that doubled this year in a bull market continues lead with corporate law amendment boost - Business PostSecurities ETF that doubled this year in a bull market continues lead with corporate law amendment boost