Surge in South Korean ETF Market: Spotlight on Power and Battery Products

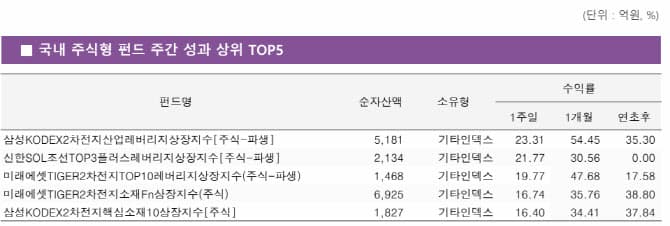

The South Korean ETF market has recently witnessed a significant surge in power and secondary battery-related products. Notably, Samsung Asset Management's 'KODEX Secondary Battery Industry Leverage' ETF posted a 23.31% return, claiming the top spot for weekly performance. The growth of the energy storage system (ESS) market and easing of decreased electric vehicle demand are seen as key factors.

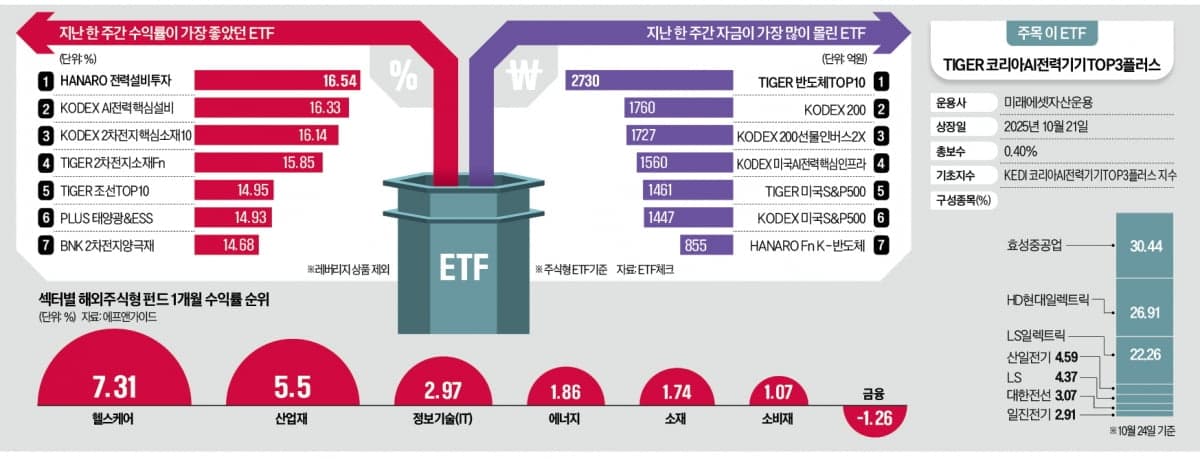

Global increases in electric vehicle sales and expectations of energy transitions have driven the substantial gains in power and battery-related ETFs. The 'HANARO Power Equipment Investment' ETF rose by 16.54%, highlighting interest in power equipment investments, with 'KODEX AI Power Core Equipment' achieving similar results.

Simultaneously, Mirae Asset Management launched a new ETF, 'TIGER Korea AI Power Equipment TOP3 Plus', drawing market anticipation. Additionally, semiconductor and U.S.-focused investment ETFs attracted substantial funds, with 'TIGER Semiconductor TOP10' ETF successfully gathering 273 billion KRW.

Conversely, precious metal ETFs like gold and silver experienced a downturn due to short-term overheating. However, there is an enduring perspective that a medium to long-term bullish outlook remains intact.

Related ETF

Related News

'Better Performing Than Semiconductors'... Top-tier Profitability 'Sweepstake' JackpotPower Equipment ETFs Soar: 16% Surge in a Week, Weekly ETF Earnings Boosted by Strong Q3 Results from Hyosung Heavy Industries, HD Hyundai Electric, LS - Entering a Long-term Growth Cycle; Battery ETFs also Strong

Related ETF

Energy Infrastructure Strengthens with Power and Secondary Battery... Gold ETFs Take a Breather [ETF Square] - Financial NewsIn the domestic exchange-traded fund market, products related to power and secondary batteries showed a significant surge. Following this, 'KODEX AI Core Power Equipment', 'KODEX Core Material for Secondary Battery 10', 'TIGER Fn Secondary Battery Material', and 'TIGER Shipbuilding TOP10' also followed. Among the top 10 ETFs, 8 were filled with power and secondary battery themes, energy..

Power & Secondary Battery ETFs Soar Together… Gold ETF Takes a Breather [ETF Square] - Financial NewsIn the domestic exchange-traded fund market, power and secondary battery-related products showed a sharp rise. Meanwhile, as the preference for safe assets settled, precious metal ETFs like gold and silver underwent adjustments. According to the Korea Exchange on the 26th, the product that recorded the highest yield in the ETF market from the 20th to the 24th was..

Related ETF

Two weeks of 'flaming pillar' rally… Leap in secondary battery ETF returns [Fund Watch]Recently, the secondary battery sector is experiencing a 'flaming pillar' for two consecutive weeks, thanks to expectations of energy storage system (ESS) growth and easing of sluggish electric vehicle demand. Following the previous week, secondary battery-related stocks continue to drive the market upward with a strong trend. As a result, related exchange-traded funds (ETFs) have also seen returns increase over the week...

Related ETF