Trends in ETF Investments by Pension Funds and Institutional Investors

Pension funds are actively investing in AI-related infrastructure and the semiconductor sector for long-term growth. According to data from the Korea Exchange, pension funds have made sizable purchases of 'KODEX US AI Core Infrastructure' and 'RISE AI Semiconductor TOP10' ETFs, amounting to 71 billion KRW and 59.5 billion KRW, respectively. This investment strategy is predicated on the expected structural growth of the AI industry and the potential benefits for domestic semiconductor firms in the reorganization of the AI chip market.

Meanwhile, Hyundai Asset Management has launched the 'UNICORN SK Hynix Value Chain Active' ETF, expecting high growth from SK Hynix, and has recorded an impressive 144.12% annual return, drawing attention in the domestic ETF market. The fund focuses on HBM technology, though its chief, SangHyun Cho, warned of the risks posed by an AI-related stock bubble.

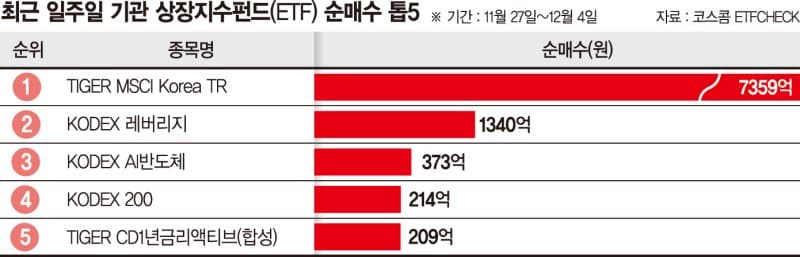

Institutional investors have recently purchased 735.9 billion KRW of the 'TIGER MSCI KOREA TR ETF' as part of their strategy, anticipating foreign investors' buying shifts and improvements in investment sentiment following the dissipation of the AI bubble. The Federal Reserve's accommodative monetary policy and stable exchange rates are also expected to encourage foreign buying, and institutions are actively buying domestically indexed funds like 'KODEX Leverage' and 'KODEX 200 ETF'.

Related ETF

Related News

ETF Yield No.1, SK Hynix Growth Forecast AccurateThis year, Hyundai Asset Management's 'UNICORN SK Hynix Value Chain Active' achieved an overwhelming yield in the domestic active exchange-traded fund market. He said, "For a while, semiconductor companies have refrained from expanding or investing, expecting demand for general-purpose semiconductors to decrease, but the advent of the AI industry has increased the demand for general-purpose memory..."

Related ETF

Is It Time for Foreigners to Return… Institutions Focus on Buying 'MSCI Korea ETF' - Financial NewsInstitutions are accumulating the Morgan Stanley Capital International Korea Index ETF. This is interpreted as an increased expectation of foreigners turning to net buying. Since overseas institutions make up the index, it serves as a standard for foreign investors in the domestic stock market...

Related ETF

[Market+] Pension Funds Focus on AI Power & Semiconductor ETFs... Betting on Long-Term Growth - Business PlusPension funds are concentrating investments in AI-related infrastructure and semiconductors, betting on long-term growth. Tracking purchases of stocks of interest to pension funds has been seen as an effective strategy, and it may be worth investigating for investors struggling to find suitable investment opportunities. According to the Korea Exchange on the 4th, in the month since November 3, pension funds have net purchased 71 billion KRW of 'KODEX U.S. AI Power Core Infrastructure' and 59.5 billion KRW of 'RISE AI Semiconductor TOP10, placing them in the top 10 rankings. These two ETFs invest in core companies in the fields of AI power infrastructure and semiconductors.

Related ETF