Memory Semiconductor Market and ETF Investment Strategies

The KOSPI index has surpassed the 5500 mark, with expectations of a rise in the stock prices of Samsung Electronics and SK Hynix. This growth is attributed to the structural expansion of the memory market and advancements in AI, with predictions that this trend will continue until 2027-2028. Nam Yong-soo, Head of ETF Management at Korea Investment Trust Management, advises individual investors to consider long-term investments in AI-related ETFs.

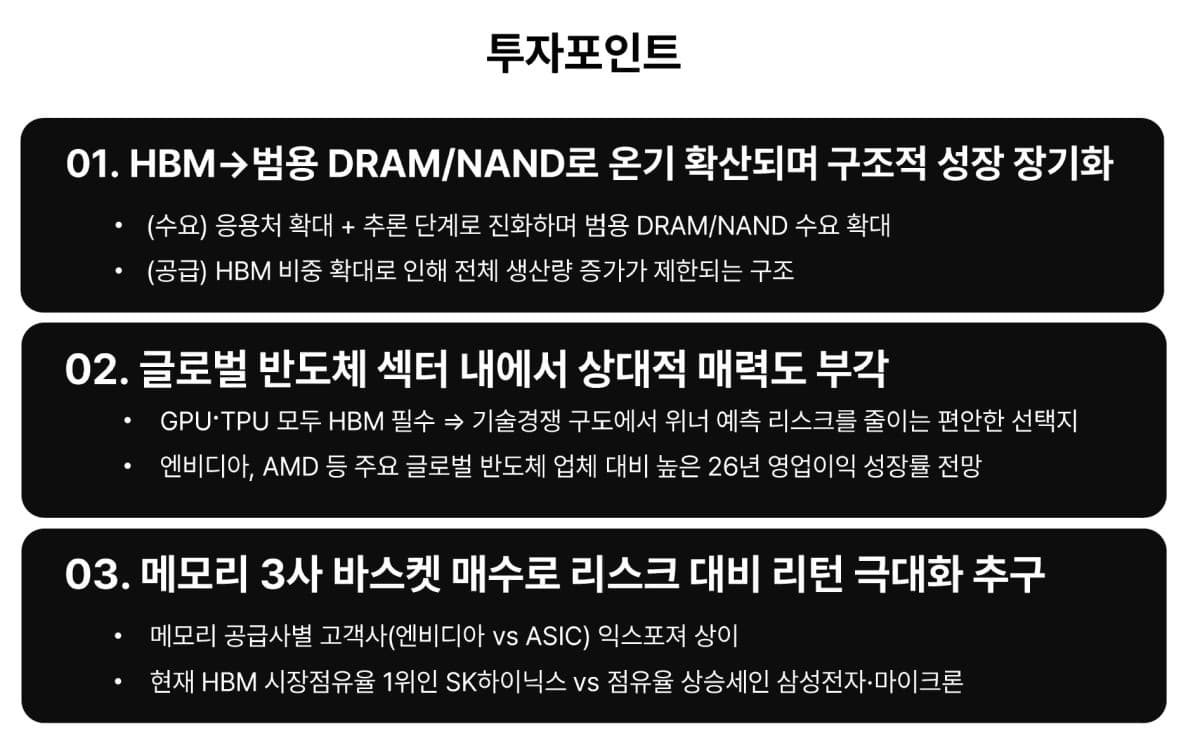

Meanwhile, Hanwha Asset Management recommends investing in 'PLUS Global HBM Semiconductor ETF' for AI memory growth and 'PLUS US High-dividend Active ETF' to secure dollar-based cash flow. The former focuses on strategic investments in leading memory companies such as Samsung Electronics, SK Hynix, and Micron, aiming for profit generation spurred by increasing demand due to AI proliferation. The latter targets stable distribution through investments in high-dividend blue-chip stocks, maintaining a flexible strategy to adapt to changes in dividend policies.

Related ETF

Related News

[Seollal Allowance Recommended ETF] AI Memory and Monthly Dividends… Capturing Both Cash Flow and Growth - E-today(Hanwha Asset Management) On the 16th, Hanwha Asset Management recommended the ‘PLUS Global HBM Semiconductor ETF’ as a 'allowance investment' strategy for individual investors focusing on AI memory growth and dollars

Related ETF

Memory Boom Until At Least 2028... Samsung Electronics & SK Hynix to Go Further [Investment Strategy in the Era of 5000 points] - The Korea Economic DailyMemory boom until at least 2028... Samsung Electronics & SK Hynix to go further [Investment Strategy in the Era of 5000 points], Interview with Nam Yong-soo, Head of ETF Management at Korea Investment Management. Structural growth of the memory market... Supplier-dominant structure. AI bubble is unfounded... Relatively low valuations