Power Industry ETFs Attract Investor Attention

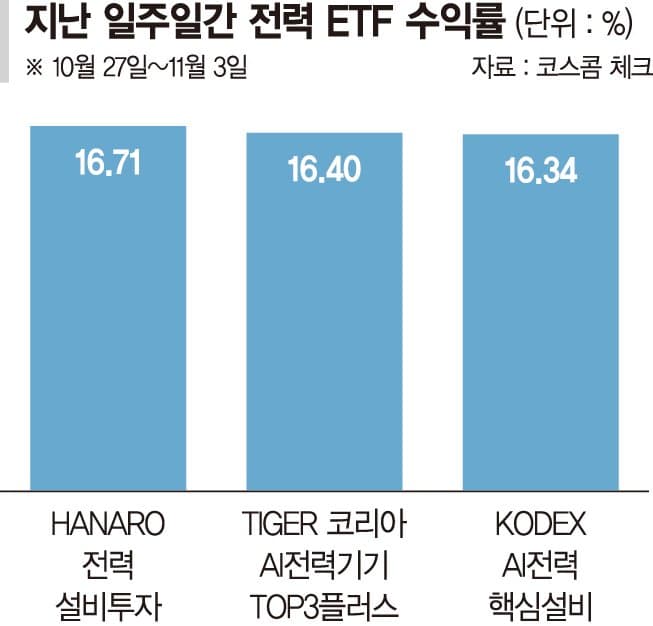

Recently, power-related ETFs have recorded high returns, drawing significant attention from individual investors. The 'HANARO Power Equipment Investment' ETF rose by 16.71% in the past week, ranking first in returns, a rise attributed to the long-term growth cycle and performance of power stocks. Experts predict this upward trend will continue into next year, likely fueling further buying activity among private investors.

Companies like HD Hyundai Electric have also shown strong performances, driving up returns of power-related ETFs. 'HANARO Power Equipment Investment' and 'TIGER Korea AI Power Devices TOP3 Plus' are thriving on the long-term growth of the power industry, bolstered by expanded power grid investments in the US and Europe and energy projects in Korea. South Korean firms are expected to expand their market share in the high-voltage transformer sector, with an emphasis on high-value-added sales and portfolio expansion.

Additionally, Mirae Asset Management's 'TIGER US AI Power SMR ETF' was completely sold out on its first trading day with 38.2 billion won in net individual purchases, marking a successful debut. This ETF invests in top-tier U.S. power infrastructure companies, with a special focus on AI-based Small Modular Reactor (SMR) firms, poised for significant growth. Backed by the U.S. government's support, these SMR companies are garnering increased attention, and the ETF aims to bolster investments in the AI power infrastructure industry.

Related ETF

Related News

Power in a Supercycle... ETF Returns Surpass Semiconductors - Financial NewsElectricity-related exchange-traded funds are receiving significant market attention due to their overwhelming returns. As they enter a long-term growth cycle, recent electricity stocks have repeatedly posted earnings surprises, showing returns that surpass the semiconductor sector, a market leader. According to KOSCOM checks on the 4th, last week...

Related ETF

TIGER U.S. AI Electric Power SMR ETF, Individual Purchases Surge to 38.2 Billion Won, Sold Out - Financial NewsMirae Asset Global Investments announced on the 4th that the 'TIGER U.S. AI Electric Power SMR ETF', which was newly listed on the Korea Exchange with a scale of 30 billion won, was completely sold out as individual purchases surged to 38.2 billion won on its first trading day. Oklo is a company invested in by OpenAI CEO Sam Altman, specializing in 4th generation SMRs for data center power demands.

Outperforming Semiconductors... 'Power ETF' on a Wild Run - Financial NewsPower-related ETFs are attracting significant market attention with impressive returns. As they enter a long-term growth cycle, recent power stocks have continually posted earnings surprises, yielding returns surpassing the leading semiconductor stocks in the market. According to the Koscom check on the 4th, in the past week...

Related ETF