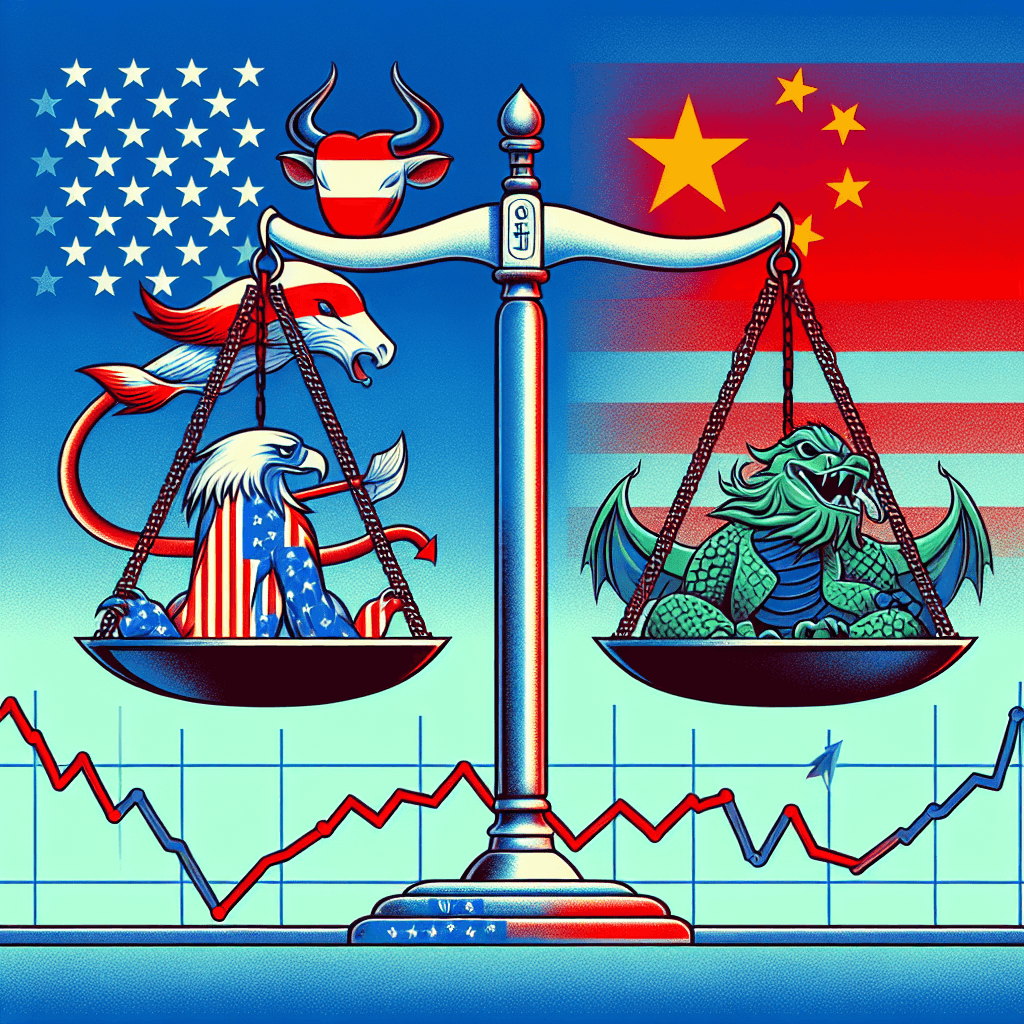

Impact of US-China Tariffs on ETF Market Volatility

The tariff war between the United States and China has amplified the losses of South Korean retail investors in leveraged ETFs. Many investors are employing an averaging-down strategy to lower the cost basis, but there are concerns that further market declines could exacerbate these losses. The Direxion Daily Semiconductor Bull 3X Shares ETF ranks first in net foreign securities purchases, highlighting the high interest of these investors in technology stocks and leveraged products.

President Trump's tariff policy is intensifying market volatility, with experts maintaining a cautious yet positive outlook until summer. The overall decline in the New York Stock Exchange is attributed to the uncertainty of tariff policies. Specifically, Tesla, which has become the most purchased US stock by Korean investors from January 20 to May 2, has suffered a loss rate of 32.27%, severely impacting investors. Direxion Tesla 2X and Semiconductor 3X ETFs have also plunged by 64.20% and 60.55%, respectively, leading to greater financial setbacks.

Recent easing in tariff pressures and the decline in 10-year Treasury yields have provided temporary relief to the markets. However, lingering uncertainties regarding tariff negotiations continue to pose threats to long-term market stability.

Related News

Falling Returns of Seohak Ants Post Trump Inauguration - Kookmin IlboSince Donald Trump became President of the United States, the stock account returns of Seohak ants have been plummeting. Seohak ants have been purchasing primarily technology stocks with large price drops and leveraged ETFs, leading to greater losses than the decline in the New York stock market. However, with measures like easing automobile parts tariffs, mutual

Korean Investors Holding Onto Leverage ETFs with 'Dollar-Cost Averaging'...When Will They Be Able to Smile? - DailianSince President Trump's inauguration, U.S. stock markets have been plunging due to trade wars, among other factors. In this situation, Korean investors who have invested in leveraged ETFs are experiencing increasing losses. Some investors with remaining capital are resorting to 'dollar-cost averaging' to reduce the average cost, but there is concern that if the market continues to drop, losses may further increase, according to Korea Securities Depository's information portal 'Savebro' as of the 2nd.