Investment Trends Among Millennials: TDFs and ETFs

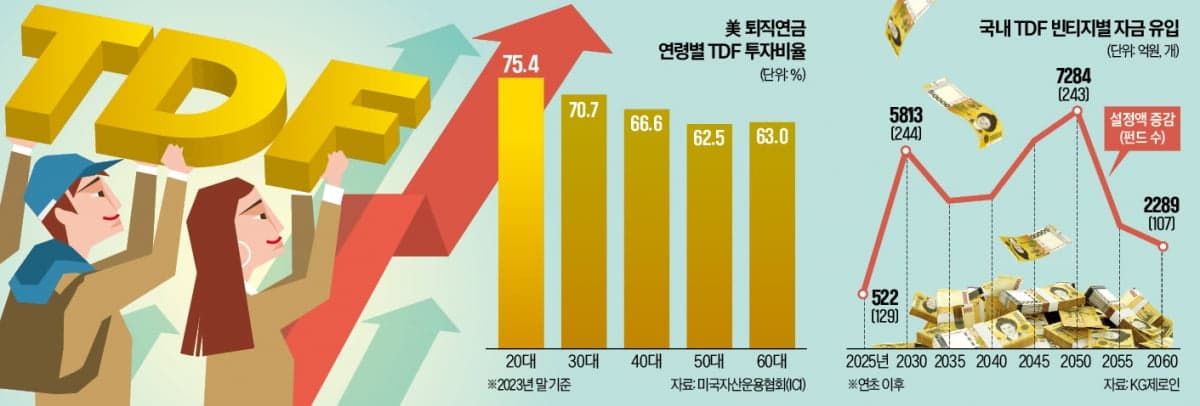

Target Date Funds (TDFs) are gaining popularity among the millennial cohort, particularly within the 20s and 30s age group. These funds adjust asset allocation automatically based on the target retirement date, with a higher equities focus seen in high-vintage TDFs being favored. In South Korea, significant inflows into 2050 TDFs have been observed, highlighting young investors' willingness to actively manage their assets for a distant retirement. In the U.S., a substantial portion, approximately 75%, of the retirement assets for those in their 20s is invested in TDFs, indicating these young investors value the convenience of automated asset rebalancing, especially due to limited investing experience.

Conversely, South Korean retirement investors are shifting funds from U.S. long-term bond ETFs to major index and AI-related ETFs in pursuit of reduced volatility and stable returns. ETFs tracking the S&P 500, Nasdaq 100, as well as AI and high-quality bond ETFs, have ranked high in net purchases, reflecting strategic maneuvers by investors to hedge against market volatility. This shift signals potential diversification in investment products and strategy adaptations in response to evolving market conditions.

Related News

2030s Become Major Players in TDF… 730 Billion Won Flows into Stock-Heavy Retirement Funds2030s Become Major Players in TDF… 730 Billion Won Flows into Stock-Heavy Retirement Funds, Last Month's TDF Inflow Analysis Shows a Higher Stock Proportion as Expected Retirement Date Delays, Resulting in Satisfying Returns. Asset Managers Automatically Adjust Proportions Without Individual Intervention. 2055 ETF Average Return Rate 15%, 2045 ETF Also Attracts 618 Billion Won

'2030 Big Player' in TDF…7.3 Trillion Won Floods into Retirement Pensions with High Stock Ratio - Korea Economic Daily2030 becomes a 'big player' in TDF…7.3 trillion won flows into retirement pensions with high stock ratio. Analysis of TDF inflows last month indicates that the later the expected retirement time, the higher the stock ratio, yielding solid returns. Asset management companies automatically adjust ratios, so individuals need not worry about assets. Average returns of 2055 ETFs are 15%, and 2045 ETFs also see 6.18 trillion won in inflows.

Betting on Stable Returns… Pension Ants Sell Long-term Bonds, Buy S&PBetting on Stable Returns… Pension Ants Sell Long-term Bonds, Buy S&P, Investment Strategies of Pension Pros Amid Increasing US Interest Rate Volatility, Long-term Bond ETF Attractiveness Declines AI & Quality Bond ETF Net Buying