Trends and Insights in the Korean ETF Market

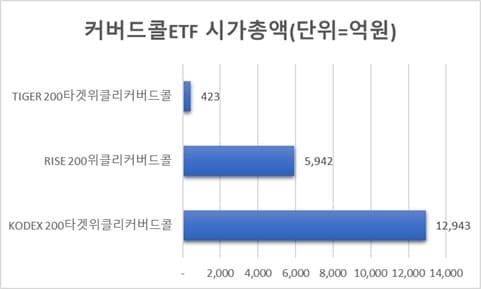

Investor interest in covered call ETFs based on the KOSPI index has surged recently. The allure of monthly dividend payments alongside tax benefits has propelled a specific ETF managed by Samsung Asset Management past 1 trillion won in market capitalization. Particularly popular among the affluent in the Gangnam area, these funds induce a 'FOMO' effect, appealing to investors prioritizing monthly cash flow over individual stock appreciation.

Simultaneously, the KOSPI200 IT index has recorded significant gains, boosting related ETFs sharply. This dynamic has intensified market competition between Mirae Asset Management and Samsung Asset Management. While Mirae Asset pioneered the first domestic KOSPI200 IT ETF, Samsung differentiates itself with a dividend reinvestment (TR) structure, drawing significant market attention.

Moreover, the rise in the KOSPI 200 index has increased the net assets of the KODEX 200 ETF, surpassing the TIGER U.S. S&P500 ETF. This shift indicates a preference for large index-tracking ETFs among individual investors. In contrast, the once-dominant TIGER ETF in American investment has turned downward, reflecting changing market dynamics.

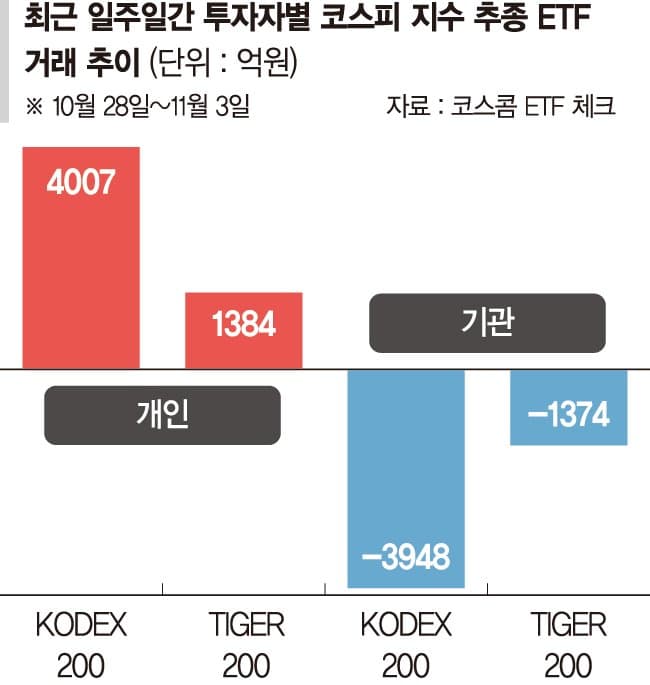

Recently, retail investors have made large net purchases of ETFs tracking the KOSPI index, significantly impacting the market. However, institutions and foreign investors are wary of overheating, resulting in their net sales. Experts warn against the continuity of this upward trend, advising investors to brace for potential short-term corrections.

Related ETF

Related News

Individual Investors Buy Kospi Tracking ETFs While Institutions and Foreigners Sell - Financial NewsSince the end of last month, individuals have aggressively purchased index-tracking ETFs, while institutions and foreigners have sold off in large quantities. Analysts suggest focusing on a long-term rise in the Kospi Index, but also caution about preparing for short-term market adjustments. Only a few large leading stocks are affecting the Kospi ...

'Betting on Korean Market' ETF beats NYSE Betting ETFThe ETF betting on the Korean market has outperformed the NYSE betting ETF, KODEX 200 ETF's net assets surpass 11 trillion KRW, overtaking the TIGER U.S. S&P 500 ETF, with a surge of investments due to the KOSPI's rapid ascent, breaking through 4,000 points and soaring up to 4,200 in a rocket-like rise.

Related ETF

'Investing in Domestic Stocks: A Matter of Intelligence?'... Surprised After Opening a Retirement Pension Account [Rapid Pension Wealthy Retirees] - The Korea Economic DailyIs investing in domestic stocks a matter of intelligence? Long-term retirement pension investments are still dominated by US and China ETFs, by reporter Han Shin Park, Securities

[ETF Matchup] KOSPI 200 IT League… Original Mirae vs Samsung Showdown - DealSiteMirae's AUM of 417.4 billion won is significantly ahead... Despite a 7-fold difference with Samsung's 63.6 billion won, competition intensifies

"Rising Less Than Market Average"... Why Are Gangnam Residents Obsessed with Covered Call ETFs? [Everyday Money-Habits M+] - Maeil Business NewspaperA significant amount of money is flowing into covered call exchange-traded funds (ETFs) that use the KOSPI as the underlying asset. The attractive marketing slogan that distributions are given monthly like a 'salary' is enticing investors. Samsung Asset Management's related ETF product is so popular that it has a market cap exceeding 1 trillion won. KOSPI-related covered calls are called 'Gangnam ETFs', implying that they are favored by wealthy individuals in Gangnam.