Dynamic Changes in the KOSDAQ and Related ETF Market

Recent developments in the KOSDAQ market and related exchange-traded funds (ETFs) indicate dynamic changes. Notably, there is heightened anticipation for the launch of KOSDAQ active ETFs, which are expected to increase fund managers' operational autonomy. Despite this, existing KOSPI-based active ETFs have shown underperformance compared to their benchmark indices, drawing attention to how these fully active ETFs will perform.

Significant fund inflows into the KOSDAQ market have also occurred, largely driven by government policies. Major ETFs like the KOSDAQ150 continue to see sustained buying from foreign and institutional investors, with the revision of pension fund management standards further encouraging investment. Consequently, market players anticipate a structural improvement in the KOSDAQ market, providing a positive outlook.

Samsung Asset Management's focused investments in KODEX KOSDAQ150 and its leveraged funds have led to a short-term rise in related stock prices. This appears to be a result of ETFs' mechanical index composition, yet the influence of shareholding disclosures on stock prices is also seen as positive.

Individual investors are actively participating in the KOSDAQ market, illustrated by investments worth billions of dollars in the KOSDAQ150 ETF. However, concerns about prices forming independent of firm fundamentals have arisen. Despite the downgrades in investment opinions on major stocks, the expectation of government policies keeps the demand-supply dynamics favorable.

Related ETF

Related News

ETF·Institutions·Foreigners Rally in KOSDAQ, Riding Policy Momentum to Grow the '3,000 DAK' DreamETF·Institutions·Foreigners Rally in KOSDAQ, Riding Policy Momentum to Grow the '3,000 DAK' Dream

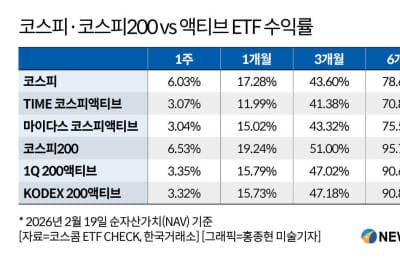

KOSPI Active ETFs Fall Short of Expectations… Controversy Over Relaxation of Correlation Regulation - NewsPim[Seoul=NewsPim] Reporter Kim Ga-hee = As expectations are rising in the market ahead of the launch of the Kosdaq Active ETF in March, it has been found that the performance of the already listed KOSPI Active ETFs is falling short of expectations. Recently, over 1 week, 1 month, and 3 months

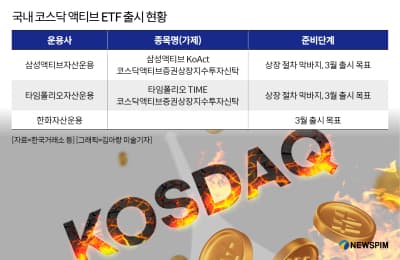

"Seeking Higher Returns than the Index"...Korea's First 'KOSDAQ Active ETF' to Launch in March - NewsPim[Seoul=NewsPim] Reporter Chaeyoung Yoon = Korea's first KOSDAQ active exchange-traded fund (ETF) is expected to be listed in March. Amid policies to revitalize the KOSDAQ market and the expansion of investment demand, the asset management industry is entering into a competition to lead the market by introducing new investment products, according to NewsPim on the 20th.

[Distorted Demand Due to ETFs] Illusion of Samsung's Massive Investment in KOSDAQ Robot Stocks - Yonhap InfomaxAs expectations for the government's domestic stock support policy grow, funds are rapidly flowing into ETFs (Exchange Traded Funds). While the impact on the KOSPI market is limited due to its large scale, the KOSDAQ market with relatively smaller market capitalization is seeing passive inflows that are significant enough to cause volatility in individual stock prices. According to the Yonhap Infomax ETP trading trends on the 20th (screen number 7131), the ETF most purchased by individual investors this year is KODEX KOSDAQ150, which attracted nearly 3 trillion won, followed by KODEX KOSDAQ150 Leverage (about 1.7 trillion won).

Related ETF

[Distortion in ETF-Initiated Demand] 'Stop Buying'…Warning for KOSDAQ Leading Stocks - Yonhap InfomaxDue to rising expectations from policies aimed at revitalizing the KOSDAQ market, funds driven by 'FOMO (Fear of Missing Out)' are flowing into KOSDAQ-related ETFs. As prices of KOSDAQ 150 stocks rise significantly based solely on passive inflows, concerns are being raised that prices are being formed irrespective of individual companies' performance or industry conditions. According to the Yonhap Infomax ETP Trading Trends (screen number 7131) on the 20th, the ETF most purchased by individual investors this year is KODEX KOSDAQ150, with nearly 3 trillion won invested. Among the top 10 ETF purchases by individuals, three are related to KOSDAQ.