Rising Popularity of ETFs and Changing Pension Investment Strategies

The popularity of Exchange Traded Funds (ETFs) is growing among pension investors, driven by an impressive return of 38.8% over the past year, significantly exceeding the average. ETFs are attractive to investors due to their low cost, real-time tradeability, and tax deferral benefits when used in pension accounts. This has led to the continuous release of products that balance stability and profitability.

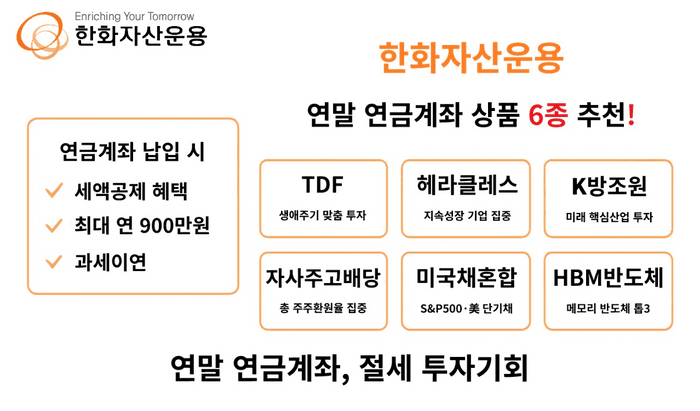

Hanwha Asset Management has introduced six investment products for pension savings and IRP accounts at the year's end, aiming for long-term stable returns. It recommends ETFs such as 'PLUS High Dividend Buyback', 'PLUS S&P500 Bond Blend 50', and 'PLUS Global HBM Semiconductor', which focus on high dividends, bond blends, and the semiconductor industry, emphasizing long-term growth potential.

According to analysis by Samsung Securities, there are clear generational differences in ETF investments within retirement pension DC accounts. The 2030 generation tends to focus on the U.S. S&P500 and Nasdaq100 indices, while the 4050 generation exhibits a more conservative approach by adding safe assets such as gold. The 60s generation adopts a diversified investment strategy, encompassing semiconductors, government bonds, and technology stocks. These trends indicate an accelerated transition to performance-linked investment products in pension investments.

Related ETF

Related News

From TDF to Semiconductor ETF…Hanwha Asset Management Recommends 6 Pension Products - Hans Economy| Hans Economy = Reporter Kim Yujin | On the 4th, Hanwha Asset Management presented six recommended products suitable for pension savings and individual retirement pension (IRP) accounts as year-end demand for pension investments increases. Among public offering funds, they recommended ‘Hanwha LIFEPLUS TDF’, ‘Hanwha Hercules Developed Markets Active’, ‘Hanwha K-Defense Shipbuilding Nuclear Power’ funds. The company focused on products that can expect stable long-term returns. ‘Hanwha LIFEPLUS TDF’ is a product that automatically adjusts the asset allocation based on the retirement date and has secured differentiated returns through collaboration with JP Morgan, specifically targeting the millennial generation born in the 1980s.

Related ETF

Which ETF Do Samsung Securities Retirement Pension Investors in Their 20s and 30s Choose? 'S&P500'... What About Those in Their 60s? - Hans EconomyHans Economy = Reporter Kim Yoo-jin | It has been found that retirement pension investors show distinct differences in their choice of exchange-traded funds (ETFs) depending on their generation. The younger generation focuses on investing in U.S. indices, whereas older individuals diversify their portfolios by adding safe assets like gold and bonds, confirming a 'life cycle investment' pattern. On the 4th, our analysis of top net buying ETFs in defined contribution (DC) accounts from January to November this year, commissioned by Samsung Securities, revealed that the top five net bought products among those in their 20s were KODEX US S&P500, TIGER US S&P500, KODEX US NASDAQ100, TIGER US NASDAQ100, AC

Which Products to Fill Year-end Pension Accounts?…Hanwha Investment, 6 Public Funds & ETFs Recommended - Dailyan MediaHanwha Asset Management has recommended six products to fill pension accounts such as pension savings and IRP (Individual Retirement Pension) as interest in pension investment grows towards the end of the year. According to Hanwha Asset Management on the 4th, the company suggested public fund products like ▲ Hanwha LIFEPLUS TDF ▲ Hanwha Hercules Developed Markets Active ▲ Hanwha K-Defense Shipbuilding Nuclear Power, focusing on products that can achieve stable returns in the long term.

Related ETF

The Secret to High Returns for Experts is ETFs… Retirement Fund 'Attention' After Leaving Savings [Smart Pension Investment②] - Dailyan MediaAs the issues of aging and low birth rates become more serious, concerns about the depletion of the national pension fund are growing daily. As a result, the importance of pension investment to secure retirement funds is emerging. In the past, the trend was to invest in products that were safe like bank deposits but had low interest rates, however, considering inflation, the real asset value is declining. From a long-term perspective, investments that are safe yet can expect high returns are...