Gold Price Rally and U.S. Biotech Market Revaluation

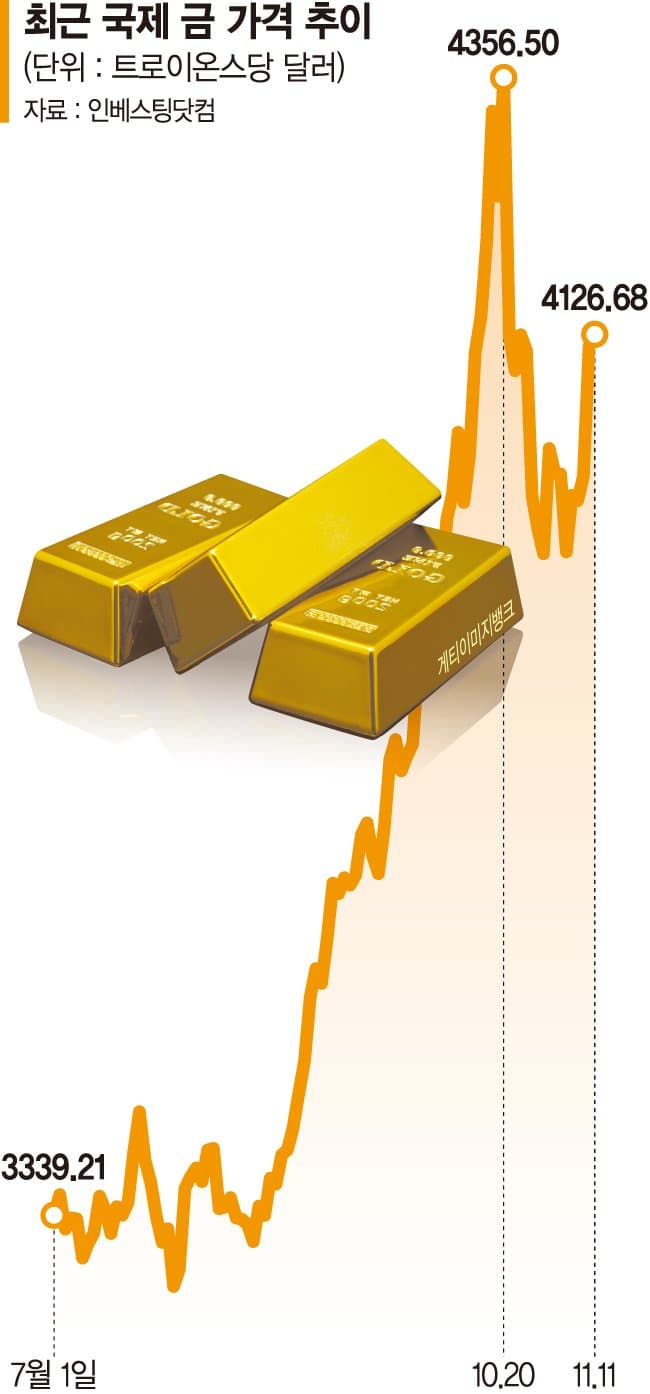

Recently, after a period of correction, gold prices have risen by 4.9% in just a week, which is also reflected in the inflow of funds to ETF products. Notably, 'ACE KRX Gold Spot' ETF attracted an investment of 62 billion KRW. This increase is driven by expectations of interest rate cuts, forecasting a long-term upward trend in gold prices with some experts projecting prices to reach $5,000 per ounce. UBS continues to view gold as a strategic asset that enhances portfolio resilience.

The U.S. biotech market is entering a phase of revaluation, driven by interest rate cuts, the loosening of drug price regulations, and a boom in mergers and acquisitions. Jo Han-gid, a manager at Samsung Active Asset Management, expressed confidence in investing in the U.S. biotech healthcare sector. He emphasized the necessity for a deep understanding of the biotech industry, advising investors to closely watch for market changes.

Related ETF

Related News

"Gold Rally Again"… Mass Inflow of Money into Gold ETFs - Financial NewsAs gold prices, which had stalled, re-enter the upward trajectory, a mass inflow of money is heading into related investment products. Experts believe that although gold prices have recently experienced increased volatility, the long-term upward trend is likely to continue. According to the investment journal Barron's, UBS stated in an analysis note on the 10th that gold prices might next year or 202..

Related ETF

Supercycle is Coming to American Biotech StocksJoe Hanky, Samsung Active Manager: "Brain Science Major Fund Manager's ETF… 3 Investment Factors"