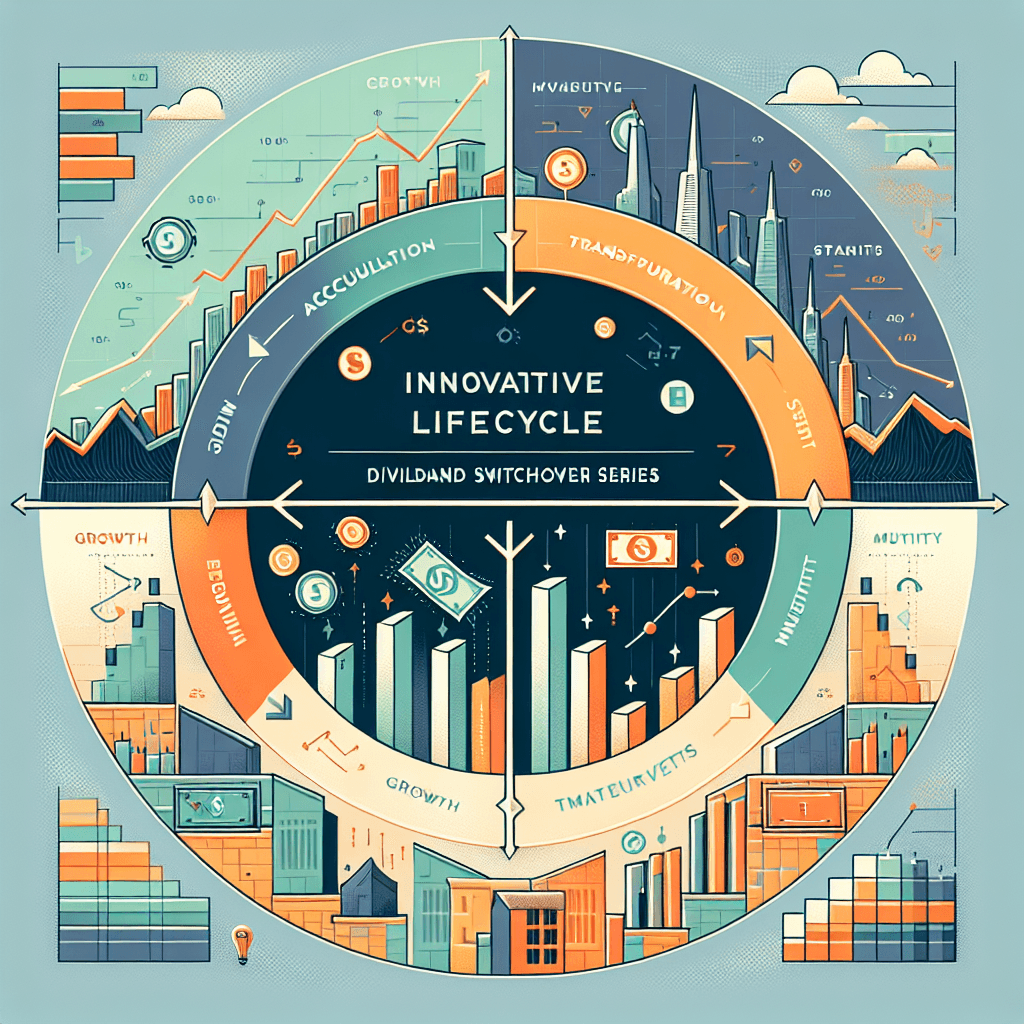

Kiwoom Asset Management's Innovative Lifecycle Dividend Switchover ETF Series

Kiwoom Asset Management has attracted attention with the launch of its lifecycle dividend switchover ETFs. The newly listed 'KIWOOM US S&P500 & Dividend Dow Jones Switchover ETF' and 'KIWOOM US S&P500 TOP10 & Dividend Dow Switchover ETF' employ a unique structure that automatically transitions from growth assets to dividend assets based on investors' lifecycle stages, a first in Korea. These ETFs are designed with a retirement target year of 2040, initially focusing on growth stocks and gradually increasing the proportion of dividend stocks as retirement approaches, providing stable cash flows at the end of each month.

The ETFs minimize tax burdens while automatically adjusting asset allocations, supporting efficient asset management post-retirement. This structure overcomes certain limitations of traditional Target Date Funds (TDFs), offering attractive tax benefits. Kiwoom plans to extend this offering with various target series, providing more options for investors. These developments reflect a strategic move towards offering more effective and flexible financial products for retirement planning.

Related News

Automatic Conversion from Growth Stocks to Dividend Stocks… Prepare for Retirement with One ETFSecurities > Policy News: “If you ignore the withdrawal problem and continue only long-term investing, you will face a tax bomb at the time of future asset withdrawal.” Kyung-Jun Lee Ki...

Kiwoom Asset Management Launches Korea's First Lifecycle ETF - Korea Economic DailyKiwoom Asset Management launches Korea's first lifecycle ETF, adjusts asset proportion based on retirement timing

Kiwoom Asset Management to List 2 ETFs Automatically Switching from Growth to Dividend Stocks in 2040 - Financial NewsKiwoom Investment Asset Management announced on the 10th that it will list 'KIWOOM US S&P500 & Dividend Dow Jones Ratio Switching ETF' and 'KIWOOM US S&P500 TOP10 & Dividend Dow Ratio Switching ETF' on the securities market simultaneously on the 11th. These products are designed to adjust from growth assets to dividend assets according to the investor's life cycle...

"Growth, Dividend, and Tax Benefits in One"… Kiwoom Asset Management Launches ETF that Automatically Switches from Growth to Dividend Stocks - NewsPim[Seoul=NewsPim] Reporter Song Ki Wook – Kiwoom Asset Management has introduced two new types of ETFs that automatically switch from growth stocks to dividend stocks according to the lifecycle. Before retirement, profits can be accumulated through growth assets, and after retirement, they switch to a dividend focus to secure a stable cash flow, embodying a 'Lifetime ETF' structure.

Ultimate Retirement Preparation... Kiwoom Asset Management Lists Automatic Growth-to-Dividend Stock Conversion ETF - Edaily'Lifecycle Dividend Conversion' ETF automatically transitions investments from growth stocks to dividend stocks, considering the life cycle—focusing on growth assets before retirement and dividend assets post-retirement.” On the 10th, Lee Kyung-jun, Head of the ETF Management Department of Kiwoom Asset Management, held a press conference at the TP Tower in Yeouido, Seoul, stating “From pre-retirement...

"Prepare for Retirement on Your Own"... Kiwoom Asset Management Lists 2 ETFs with 'Growth to Dividend Asset Automatic Conversion'Kiwoom Asset Management announced at a press conference held at the TP Tower in Yeouido, Seoul, on the 10th, that it will simultaneously list two types of 'KIWOOM Lifecycle Dividend Transition 2040 ETF (Exchange Traded Fund) series' on the stock market. The newly listed products on the 11th are 'U.S. S&P500 & Dividend Dow Jones Weight Transition' and 'U.S. S&P500 TOP10 & Dividend Dow Weight Transition'. These products apply the 'Lifecycle Dividend Transition Strategy', which automatically converts growth assets into dividend assets according to the investor's lifecycle. This is the first stock-type lifecycle ETF series in Korea.

Kiwoom Asset Management Launches 'Automatic Dividend Conversion' ETF Targeted at Retirement Date… “Ensuring Dividends While Saving on Taxes” - Chosun IlboKiwoom Asset Management is launching an ETF that automatically converts the proportion of U.S. growth assets to dividend assets by the retirement year 2040. Unlike conventional Target Date Funds (TDFs), which focus on bonds, this ETF will focus on increasing the proportion of dividend-paying stocks.

“Capture Returns, Dividends, and Tax Benefits”…Kiwoom Management, First Listing of 'Lifecycle Dividend-Transition ETF' - Cookie NewsKiwoom Investment Management will launch on the 11th the ‘KIWOOM US S&P500 & Dividend Dow Jones Weight Transition ETF’ and ‘KIWOOM US S&P500 TOP10 & Dividend Dow Fund.

Kiwoom Asset Management Lists Two Domestic First '2040 Growth to Dividend Stocks Automatic Conversion ETFs' - eTodayGrowth assets include S&P500 and S&P500 TOP 10 stocks; dividend assets are US Dividend Dow Jones... Dividends paid at the end of the month. Kiwoom Asset Management will list on the 11th ‘KIWOOM US S&P500 & Dividend Dow Jones