Bio ETFs and Safe Assets Attraction in the ETF Market

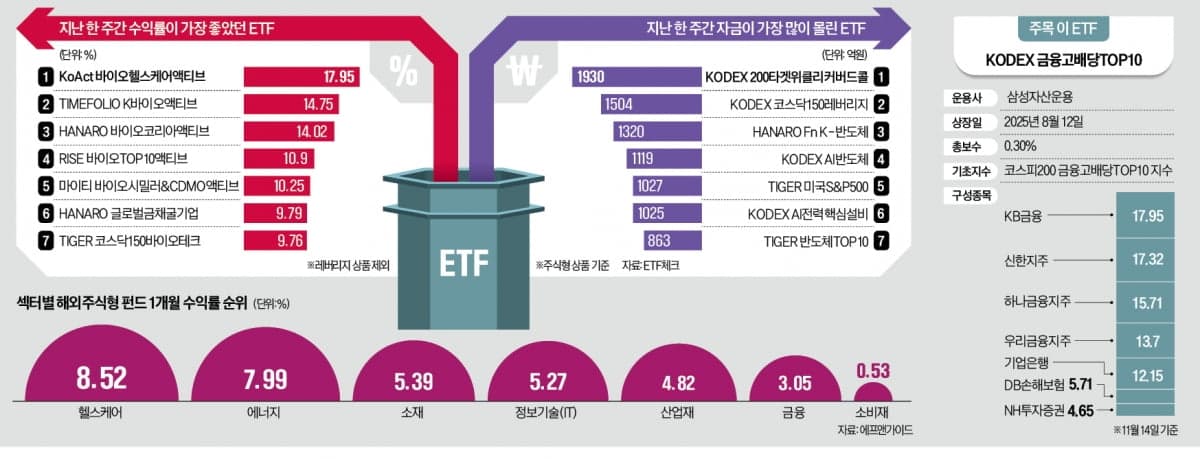

In the recent ETF market, bio exchange-traded funds (ETFs) experienced high returns influenced by large-scale technology transfer contracts. Notably, 'KoAct BioHealthcare Active' exhibited an impressive performance with a 17.95% return, also attracting significant inflows into KOSDAQ leverage ETFs. This trend indicates the sustained investment attractiveness of the bio sector.

Conversely, due to increasing market volatility, there has been a clear preference for safe assets among investors. Substantial funds flowed into financial bonds, covered call, and gold bullion ETFs. 'KODEX 26-12 Financial Bond (AA- and Above) Active' recorded a net inflow of 2447 billion won. These products provide stability in rapidly changing markets, with 'ACE KRX Gold Bullion' also attracting 1612 billion won.

Meanwhile, products betting on the rise of the domestic stock market also thrived. 'KODEX 200 Target Weekly Covered Call' and 'KODEX KOSDAQ 150 Leverage' attracted substantial funds, suggesting that investors maintain confidence in the domestic market.

Related ETF

Related News

K-Bio Sweeps Top Ranks... Retail Investors Bet on Index RiseK-Bio Sweeps Top Ranks... Retail investors betting on index rise, Bioactive ETF products took top 1-5 spots in weekly returns last week, attracting billions in new funds to products like KODEX200 Covered Call and KOSDAQ150 Leverage.

Related ETF

“Heart-pounding roller coaster market”…Funds move to bonds and gold ETFsAs stock market volatility increases, a shift to safe assets occurs

Related ETF