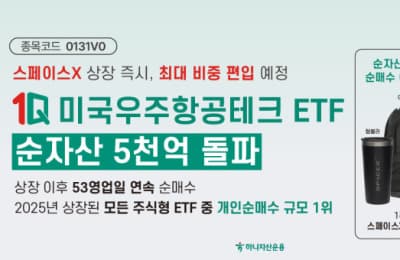

Hana Asset Management's '1Q US Aerospace Tech ETF' Surpasses 500 Billion KRW in Net Assets

Hana Asset Management's '1Q US Aerospace Tech ETF', listed last November, has surpassed 500 billion KRW in net assets approximately 11 weeks post-listing. The ETF primarily invests in leading US aerospace tech companies such as Rocket Lab and Joby Aviation, and continues to gain popularity among individual investors. Currently, the net purchase by individual investors amounts to 326.2 billion KRW, marking the highest investment inflow among equity ETFs.

Should SpaceX move forward with its IPO, the ETF plans to include it at the highest allocation. This decision aligns with SpaceX's ongoing efforts to establish AI infrastructure following its recent merger with the AI company, xAI. These initiatives by SpaceX, including the development of Starlink-based AI infrastructure, signal promising growth prospects, which have attracted further investment inflows anticipating the company's market debut.

Hana Asset Management intends to continue releasing differentiated ETF products, providing investors with diverse options and aiming for sustained growth. The consistent purchase momentum aligns with the positive growth forecast for the industry, creating a favorable investment environment for investors.

Related News

1Q U.S. Aerospace Tech Captivates Investors for '53 Trading Days' - Hans EconomySeoul = Choi Cheon-wook, Hans Economy Reporter | The '1Q U.S. Aerospace Tech ETF', the first U.S. aerospace tech index fund to be listed in Korea by Hana Asset Management on November 25 last year, has captivated individual investors for 53 consecutive trading days. According to the Korea Exchange on the 10th, these 53 trading days mark the longest streak of individual net buying among all ETFs listed last year, and the cumulative volume is also approximately 326.2 billion KRW, making it the largest among all equity-type ETFs that year. Hana Asset Management reported that thanks to net buying from individual and pension investors, the '1Q U.S. Aerospace Tech ETF' surpassed 500 billion KRW in net assets in approximately 11 weeks after listing.

Hana Asset Management's '1Q US Aerospace Tech' Surpasses 500 Billion Won in Net Assets - E-TodayHana Asset Management announced on the 11th that the '1Q US Aerospace Tech ETF', listed on November 25 last year, has surpassed 500 billion won in net assets thanks to individual net buying.

Hana Asset Management's '1Q U.S. Aerospace Tech ETF' Surpasses 500 Billion KRW in Net Assets... Just 11 Weeks Since Listing - Seoul Economic DailyHana Asset Management announced on the 11th that the '1Q U.S. Aerospace Tech ETF', Korea's first U.S. aerospace technology ETF listed on November 25 last year, surpassed 500 billion KRW in net assets in just about 11 weeks, driven by net purchases from individual and pension investors. According to Hana Asset Management, this product is listed

Hana Asset Management's '1Q U.S. Aerospace Tech' Surpasses Net Assets of 500 Billion Won - NewsPim[Seoul=NewsPim] Reporter Kim Ga-hee = Hana Asset Management announced on the 11th that its '1Q U.S. Aerospace Tech' ETF, the first U.S. aerospace tech ETF listed in Korea on November 25 last year, surpassed a net asset value of 500 billion won approximately 11 weeks after listing. The 1Q U.S. Aerospace Tech ETF is

'1Q Aerospace Tech' ETF Ranked No. 1 in Personal Net Purchases Last Year…"SpaceX Awaiting Inclusion" - Yonhap InfomaxThe largest stock-type exchange-traded fund (ETF) chosen by individual investors last year was Hana Asset Management's Aerospace Tech ETF. According to Hana Asset Management on the 11th, the '1Q U.S. Aerospace Tech' ETF had the largest net purchase amount by individuals last year, with 326.2 billion won, among all stock-type ETFs listed throughout the year. This ETF is the first in Korea to focus on investing in leading U.S. space and aerospace tech companies. Key holdings include Rocket Lab and Joby Aviation, each accounting for about 16%, and investments in Palantir, GE Aerospace, AST SpaceMobile, and Archer Aviation.