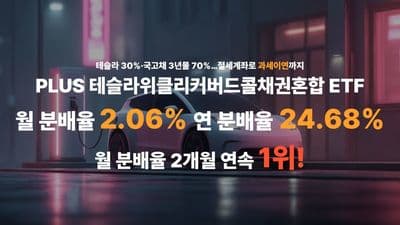

Hanwha Asset Management Achieves Highest Payout with 'PLUS Tesla Weekly Covered Call Bond Mix' ETF

Hanwha Asset Management's 'PLUS Tesla Weekly Covered Call Bond Mix' ETF has announced a high dividend of 200 KRW per share, setting the highest payout rate among monthly dividend ETFs in the domestic market. The monthly distribution rate of 2.06% translates to an annualized rate of 24.68%. This impressive payout rate is achieved through a portfolio consisting of 30% Tesla stocks and 70% 3-year government bonds, coupled with a covered call strategy.

The ETF's unique investment strategy involves selling 50% of the weekly Tesla call options and using the premium received as a resource for distributions. This offers attractive and predictable monthly returns for investors.

Since its listing, the ETF's net asset value has grown approximately 10 times, reaching 91.2 billion KRW. This reflects the ETF's growing popularity and trust among investors. Hanwha Asset Management also highlights the deferred taxation benefits associated with this product.

Related News

Hanwha Asset Management's 'Tesla Weekly Covered Call Bond Mix', Distribution Rate 2.06%... 'Top Monthly Dividend' - meconomynews.comHanwha Asset Management announced on the 20th that the 'PLUS Tesla Weekly Covered Call Bond Mix' ETF (Exchange-Traded Fund) recorded the highest distribution rate of 2.06% among domestic listed monthly dividend ETFs this month. According to Koscom ETF CHECK, the ETF's monthly distribution rate was 2.06% based on the closing price prior to the distribution (on the 11th), with an annualized rate of 24.68%. This is the highest figure among domestic listed monthly dividend ETFs. Accordingly, the ETF will pay a dividend of 200 KRW per share in February. Last month, it also distributed a monthly dividend of 212 KRW per share, achieving the top distribution rate (2.11%).

PLUS Tesla Covered Call Bond Mix, Top Distribution Rate in February - Hans Economy| Seoul=Hans Economy Reporter Kim Yujin | Hanwha Asset Management announced on the 20th that the February distribution rate of the 'PLUS Tesla Weekly Covered Call Bond Mix' Exchange-Traded Fund (ETF) is the highest among monthly dividend ETFs listed in Korea. Based on the closing price before the ex-dividend date (11th), the monthly distribution rate is 2.06%, and the annualized distribution rate is 24.68%. In January, it also ranked first with a monthly distribution of 212 won per share (2.11%). The 'PLUS Tesla Weekly Covered Call Bond Mix' ETF is a bond mix-type ETF that invests 30% in Tesla and 70% in 3-year government bonds. It uses a covered call strategy to achieve predictable monthly dividends.

PLUS Tesla Weekly Covered Call Bond Mixed, Distributing 200 Won Per Share in February - News Pim[Seoul=News Pim] Reporter Yang Tae-hoon = Hanwha Asset Management announced on the 20th that the 'PLUS Tesla Weekly Covered Call Bond Mixed' ETF (Exchange-Traded Fund) will pay a dividend of 200 won per share in February. Based on the closing price prior to the ex-dividend date (11th), the monthly distribution rate is 2.06%, and the annualized distribution rate stands at 24.68%.