Shifts in the Korean ETF Market and Key Trends Among Individual Investors

Hana Asset Management has reduced the total cost of the KOSPI 200-based active ETF to an unprecedented low in the domestic representative index. This move targets long-term investors by underscoring the potential for fee differences to compound into returns over time. The ETF, which uses the KOSPI 200 index as its base, pursues excess performance through various strategies including arbitrage and IPOs, achieving a remarkable annual return of 94.99% last year. This year also forecasts continued growth in major industries and positive policy momentum.

The rise of the Kosdaq index is spurring individual investors to purchase Kosdaq ETFs. Samsung Asset Management's KODEX Kosdaq150 posted a record individual net purchase of over 1 trillion won on the 26th and 27th, marking an all-time high. As the government pushes forward policies to develop Kosdaq as a growth platform for innovative businesses, interest from individual investors is escalating. Mirae Asset Management is actively promoting events related to Kosdaq ETFs.

Leveraged ETFs that track double the Kosdaq index have recently recorded high returns. In this environment, individual investors have been making substantial investments in leveraged products, pushing cumulative net purchases of Kosdaq ETFs to 1.7 trillion won. However, there is a cautionary note about the potential for significant losses should market volatility increase, urging investors to exercise caution.

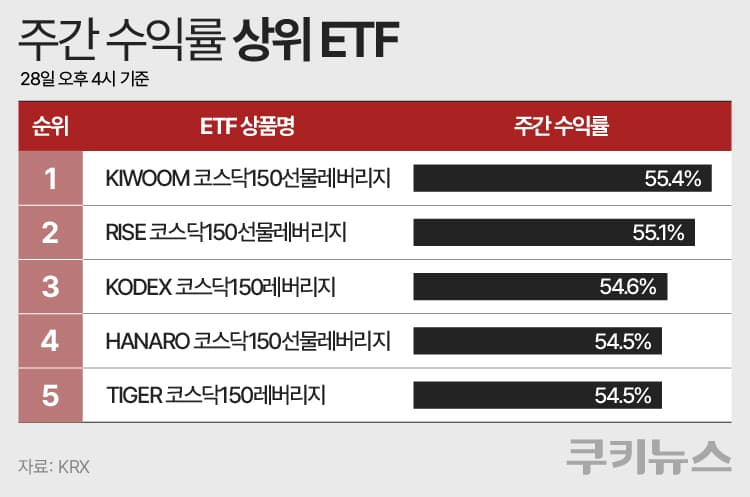

The Kosdaq index has hit its highest point since the IT bubble burst, and related ETFs continue to post high returns. In the past week, leveraged ETFs have dominated the top 1-5 positions in terms of returns, receiving robust buying support from individual investors. Notably, KODEX Kosdaq150 saw a record net purchase of 1.076 trillion won over two days, demonstrating concentrated interest from investors.

Related ETF

Related News

Hana Asset Management Cuts 'Active ETF' Fees to Lowest Level... 'Will Lead Long-term Pension Investment Culture' - Financial NewsHana Asset Management has reduced the total fees of Korea's KOSPI 200-based active ETFs to the lowest level among major national indices, targeting long-term pension investors. On the 28th, Hana Asset Management held an online press conference themed 'New Standards for Domestic Investment in the Era of KOSPI 5000' and discussed the management of '1Q 200 Active ETF'...

Bitter Experience from Leveraged KOSPI ETFs... Retail Investors Charge at 'Cheonsdaq' with KOSDAQ ETFs - Cookie NewsAs many individual investors have tasted bitterness from betting against the rising KOSPI, a surge in retail investors is now staking their efforts on 'Cheonsdaq'.

In the Kosdaq Volcanic Eruption... Individuals Collect Kosdaq ETFs - Financial NewsAs the domestic Kosdaq index opens the era of 'Thousand Kosdaq' for the first time in over four years, the buying frenzy of Kosdaq ETFs by individual investors is accelerating. Consequently, Samsung Asset Management's KODEX Kosdaq150 saw net purchases exceeding 1 trillion won in just two days, the 26th and 27th. A Samsung Asset Management official stated, "This is unprecedented in the past 24 years of domestic E..."

Related ETF

When KOSDAQ Hits 1,000, Retail Investors Massively Buy ETFs...Website Crash - Chosun IlboAs the KOSDAQ index reached an all-time high of 1,080 since the IT bubble burst, KOSDAQ-listed ETFs hit the jackpot. The buying spree of individual investors continues. According to Koscom ETF Check, in the past week

Related ETF