New Developments and Growth Prospects in the Korean ETF Market

The financial authorities have approved the introduction of 2x leveraged ETFs based on major domestic stocks like Samsung Electronics and SK Hynix. This product reflects double the price changes of the underlying stock, and mandatory pre-investment education will be required for investor protection. Notably, 3x leverage is not permitted, and regulations related to CEO reappointment within the financial sector will also be tightened.

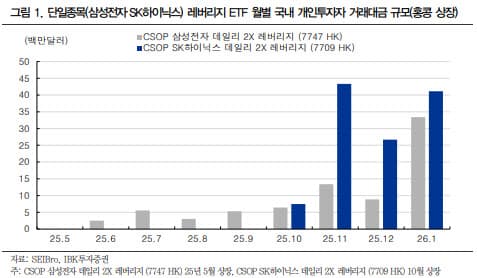

Furthermore, the introduction of single-stock leverage and inverse ETFs could potentially absorb the high-risk, short-term investment demand that has been flowing overseas. Consequently, this could lead to increased volatility focused on leading stocks. In-sik Kim, a researcher from IBK Investment & Securities, suggested that managing the volatility of leveraged ETFs by tracking earnings up to twice daily is necessary. The introduction of ETFs is expected to take several months, with initial listings likely focused on large-cap stocks with active options trading.

NH-Amundi Asset Management's 'HANARO Fn K-Semiconductor ETF' has surpassed 1 trillion won in net assets, aided by the expansion of AI infrastructure. This fund has achieved high returns by investing primarily in 20 domestic semiconductor companies, including Samsung Electronics and SK Hynix. These companies are anticipated to continue their growth trajectory as key suppliers to the global AI infrastructure.

Related ETF

Related News

NH-Amundi's 'HANARO Fn K-Semiconductor ETF' Surpasses 1 Trillion KRW in Net Assets - Metro NewspaperNH-Amundi Asset Management's 'HANARO Fn K-Semiconductor ETF', which invests in core sectors of the domestic semiconductor industry, has surpassed a net asset value of 1 trillion KRW. As the AI infrastructure expands, establishing a market advantage for semiconductor suppliers, funds are being attracted to related exchange-traded funds (ETFs). On the 29th,

Related ETF

Single Stock Leverage and Inverse ETFs Set for Introduction... Potential for Expanded Volatility in Leading StocksIf leverage and inverse exchange-traded funds (ETFs) based on single stocks are introduced domestically, they can absorb some of the high-risk, short-term investment demand that has been flowing overseas. However, there is also a diagnosis that the volatility of leading stocks could expand and trading patterns might change. Kim In-sik, IBK Securities...

Financial Services Commission Chairman: 'Double leveraged ETF allowed for single top domestic stock' - Chosun IlboThe Financial Services Commission Chairman allows double leveraged ETFs for single top domestic stocks to protect investors by not considering triple leverage. The financial authorities permit the introduction of ETFs with double leverage, using top domestic single stocks such as Samsung Electronics or SK Hynix as underlying assets. The price changes to double the daily stock price increase or decrease.