Samsung Active Asset Management Seeks Strategies to Overcome ETF Crisis

Samsung Active Asset Management’s U.S.-based brain disease treatment ETF is facing delisting risks due to shrinking net assets. In response, the fund has renamed itself 'Samsung Active KoAct U.S. Alzheimer's & Brain Disease Treatment Active ETF' and has switched its benchmark index to the Solactive US Alzheimer's & CNS Therapeutics Index. This is seen as a strategic move to re-engage investors and emphasize the ETF's unique value proposition.

The brain disease treatment market is projected to grow at an annual rate of 16-32% by 2030, which presents potential growth avenues for the ETF. Nevertheless, the sector also faces challenges such as stiff market competition and a lack of investor focus, which currently contributes to asset depletion. Market analysis indicates that ongoing innovations in this sector, along with FDA approvals, could critically impact the ETF's future performance.

Ultimately, Samsung Active Asset Management aims to highlight the ETF’s strengths to expand its market share, potentially aiding in restoring trust among investors and stakeholders. These changes also offer important implications for investors exploring newly emerging opportunities within the brain disease treatment market.

Related News

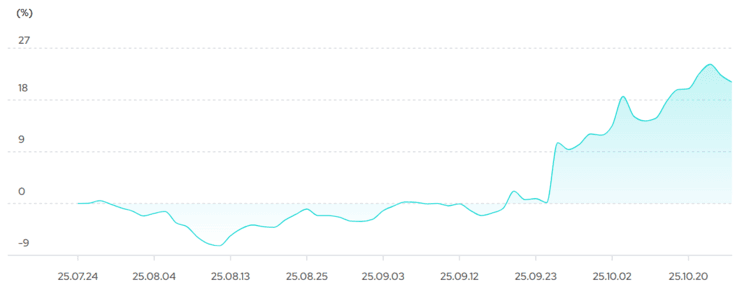

[ETF Resuscitation] Expanding Beyond Brain Disorders to Dementia…Rebound with 23% Return - Deal siteAUM dropped to 7 billion won, but added dementia to the name to restore public awareness and rebranded

[ETF Resuscitation] Abandoned Brain Disorders for Dementia... But even 7 Billion is at Risk - DealSitePerformance at a decent 23%... Low public recognition leads to the addition of 'Dementia' in the name for rebranding