ETF Trends: AI Investment and Performance Analysis in Volatile Markets

Samsung Asset Management has highlighted ETFs focused on structural growth themes related to the spread of AI as promising investment options. 'KODEX AI Semiconductors', 'KODEX AI Core Power Equipment', and 'KODEX US Nuclear SMR' ETFs target sectors like semiconductors, power infrastructure, and next-generation energy reflecting increased AI demand. This strategic approach aims for long-term growth based on the influence of AI across diverse industries.

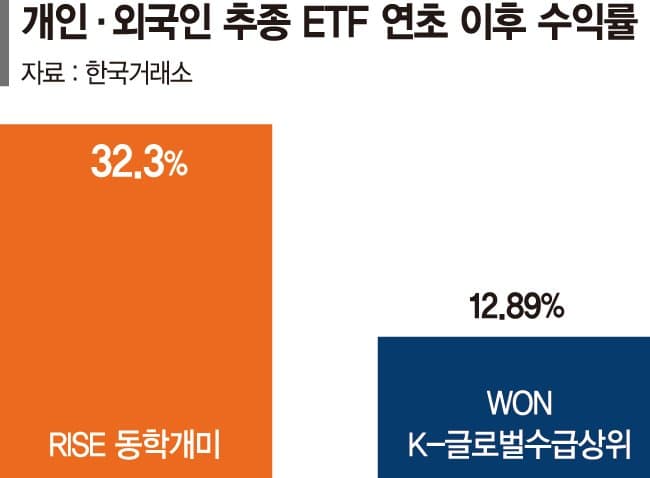

Meanwhile, in this year's market, the 'RISE Donghak Ants' ETF achieved an impressive 32.3% return, outperforming the KOSPI index. This suggests that an aggressive investment strategy can yield high returns even in volatile market conditions. On the other hand, the 'WON K-Top Global Demand' ETF posted only a 12.89% increase, following foreign investment demand trends. This indicates that performance can vary significantly based on each ETF's portfolio composition and individual investment strategies. This analysis underscores the importance of risk management and strategic investment for investors navigating unpredictable market environments.

Related ETF

Related News

"Better Than Foreign-Focused ETFs" Earnings Doubled When Following Individuals - Financial NewsIt was found that the Donghak Ant products achieved high returns during the bull market since the beginning of the year. The RISE Donghak Ant, listed in December last year, is an investment product that selects top-performing stocks among those with high net purchases by individual investors. During the same period, ETFs following foreign investor flows had index returns..

[Lunar New Year Allowance Recommended ETF] “Ride the AI Megatrend”...Samsung Asset Management suggests Semiconductor, Power, SMR ETFs - E-Today(Samsung Asset Management) On the 18th, Samsung Asset Management presented the 'KODEX AI Semiconductor', 'KODEX AI Core Power Equipment' as investment opportunities in structural growth themes following the spread of Artificial Intelligence (AI).

Related ETF