Decline in Gold Prices and ETF Market Adjustment

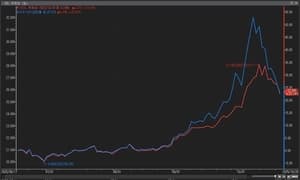

Gold prices have recently experienced a significant drop, leading gold-related ETFs into an adjustment phase. With a decline of over 9% from all-time highs, primary gold ETFs have decreased by up to 12%. Experts perceive this as a 'healthy correction,' forecasting that ongoing gold purchases by central banks will provide support for prices.

In the domestic market, the collapse of the 'Kimchi Premium' in gold is particularly noteworthy. The ETF tracking KRX gold spot plummeted 22% from its peak, attributed to both the fall in international gold rates and the resolution of excessive domestic market premiums. This adjustment has realigned domestic gold prices closer to international levels, which is seen as a long-term positive shift. Analysts view the current environment as an opportunity for value-buying, and potential changes in US Federal Reserve monetary policy could further bolster favorable outlooks for gold.

Related News

Plummeting Gold Prices... ETFs Also Collapse - Financial NewsThe price of gold, once a key player in the 'everything rally', is collapsing. On the 27th, in the international gold spot market, the price of gold fell to $3,970 per ounce during the day. This is more than a 9% drop in just one week compared to the all-time high recorded on the 20th.

'Kimchi Premium' Resolved... KRX Gold Spot ETF Plummets 22% in Two Weeks - Yonhap InfomaxThe 'Kimchi Premium' in the domestic gold market, which once surged close to 20% and sparked overheating debates, has collapsed. The adjustment in international gold prices acted as a trigger, rapidly deflating the abnormally inflated price bubble. The related exchange-traded fund (ETF) has plummeted more than 20% from its peak. According to the financial investment industry on the 28th, the representative ETF tracking KRX gold spot, 'ACE KRX Gold Spot', is trading at 25,715 KRW today. This is a 22% drop compared to the short-term peak of 32,795 KRW recorded nine trading days ago on the 16th. In comparison, international gold price-linked ETFs fell by 9% during the same period.