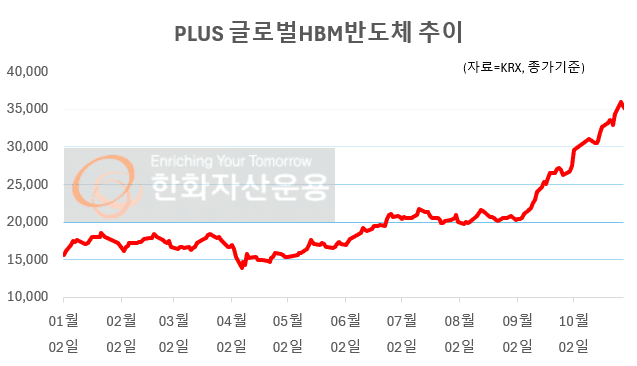

Korean Semiconductor ETF Outperformance Driven by Stock Surge

Korean semiconductor-related ETFs are seeing significant gains, propelled by the strong performance of stocks like Samsung Electronics and SK Hynix. Leading this surge, the KODEX and TIGER semiconductor leveraged ETFs have seen increases of 148.8% and 147.5%, respectively, far outperforming the overall KOSPI index. Financial experts view this trend as a strong indicator of robust growth within the semiconductor sector.

Conversely, funds from VIP Asset Management that hold a lower proportion of Samsung Electronics and SK Hynix shares are posting lower returns. This divergence highlights the critical market roles these two companies play. Experts predict that the ongoing evolution of the AI industry will continue to drive semiconductor demand, which in turn is expected to positively influence ETF performance.

The KOSPI index's breakthrough above 4,000 points is being driven largely by rising stock prices in Samsung Electronics and SK Hynix. The momentum in semiconductor stocks is maintained by the AI boom and shortages in HBM (High Bandwidth Memory) supplies. Consequently, brokerage firms are raising their target prices for Samsung and SK Hynix, forecasting that the semiconductor industry is entering a phase of structural growth.

Related News

Semiconductor Stocks Ushering in the KOSPI 4000 Era, Consider ETFs? - Cookie NewsThe KOSPI 4000 era has begun. Samsung Electronics and SK Hynix are showing a strong upward trend, pushing the index higher. These are known as the representative stocks '100,000 Electronics' and '500,000 Nics'.

150% in 3 Months... Semiconductor ETF Sweeps Top Yielders - Chosun Ilbo150% in 3 months, Semiconductor ETF Sweeps the Top Yielders, Overwhelming KOSPI Gains With the strong performance of major semiconductor stocks like Samsung Electronics and SK Hynix, semiconductor-focused ETFs among Korean-listed ETFs are sweeping the top ranks in returns. According to the Korea Exchange and FnGuide on the 28th, recently