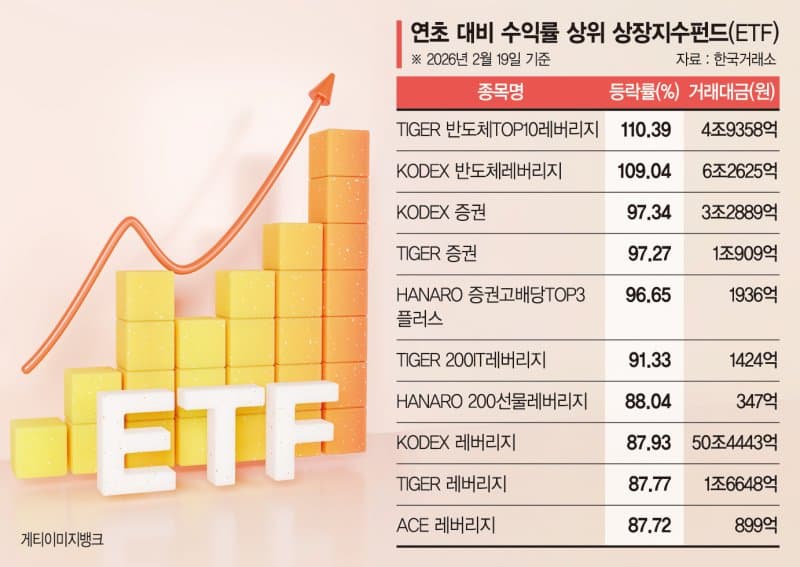

Semiconductor Leverage ETFs Lead the Bull Market

In recent developments, semiconductor leverage ETFs in the South Korean stock market have captured significant attention due to their outstanding performance. The 'TIGER Semiconductor TOP10 Leverage' ETF posted a remarkable return of 110.39% year-to-date, while 'KODEX Semiconductor Leverage' ETF increased by 109.04%. These impressive gains were facilitated by the resurgence in global economic activity, enabling them to capitalize on the amplified price movements of major semiconductor stocks such as Samsung Electronics and SK Hynix.

Anticipating further development, financial regulatory authorities have plans to permit the launch of single-stock leverage ETFs to invigorate the domestic market. This initiative is expected to expand investor choices and enhance the trading volume and liquidity in the local stock exchange. Moreover, with the KOSPI index reaching an all-time high, other thematic ETFs are also exhibiting strong performances. For instance, the HANARO High Dividend TOP3 Plus ETF achieved the highest growth among large-cap ETFs. Contrarily, inverse ETFs are witnessing a decline, reflecting a countertrend to the overall market rally.

Related ETF

Related News

"Doubled"… Semiconductor Leverage ETF Investors 'Beaming' - Financial NewsA leveraged ETF that doubled compared to the beginning of the year has emerged due to a booming stock market. Among the 4,400 ETFs listed in the US stock market, 6 products have surpassed a 100% return since the beginning of the year. All domestic ETFs that exceeded a 100% return are semiconductor leverage products.

Related ETF

"Doubled Since Early This Year"...ETF Investors All Smiles - Financial NewsAn exchange-traded fund that has doubled since early this year has emerged amid a boom. Among over 4,400 ETFs listed on the U.S. stock market, six products have achieved returns exceeding 100% compared to the beginning of the year. All domestic ETFs with returns exceeding 100% are semiconductor leverage products.

KOSPI Bull Market Drives 'Thematic ETFs' Surge…Inverse Losses Expand - Newspim[Seoul=NewsPim] Reporter Lee Na-Young: On the 19th, KOSPI closed at 5670 points, marking a record high. In the Exchange Traded Fund (ETF) market, leveraged and thematic products took the top ranks in returns. As the upward momentum of the index expanded, funds betting on an upward trend flowed in, whereas inverse...