Changes and Prospects in the Gold and Silver ETF Markets

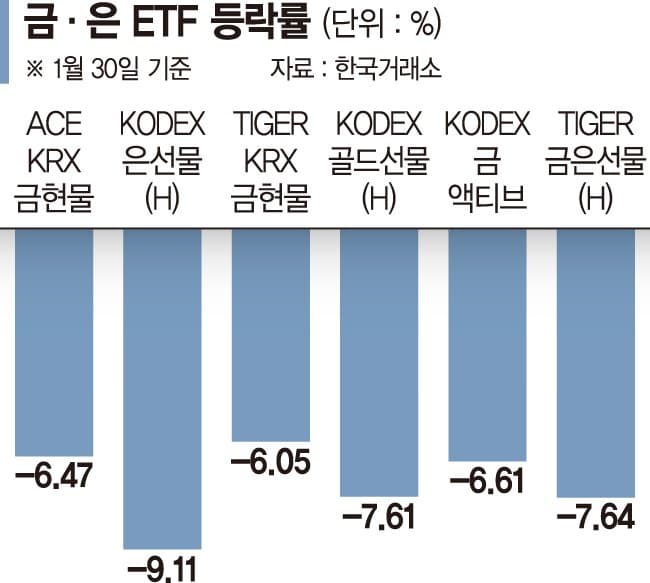

Last month, the net assets of domestic gold and silver-related exchange-traded funds (ETFs) exceeded 10 trillion won. This suggests that as safe assets, gold and silver have gained focus among investors. However, the recent sharp decline in gold and silver prices has added volatility to the market. This arises alongside reduced expectations of U.S. monetary policy easing, and suggests that the instability in gold and silver prices will likely persist.

The nomination of Kevin Warsh, a former Federal Reserve governor known as a 'hawkish dove', as the next Federal Reserve Chair has increased volatility in gold and silver. His perceived stance is negatively impacting the pricing of these metals. The price of silver fell by 31.37% last month, and gold also recorded an 11.39% decrease. Such fluctuations originate from diminished market expectations for large-scale liquidity support.

In the medium to long term, gold and silver are still regarded as safe assets, and their popularity is likely to persist. This is driven by the depreciation of currency values, and there is also the potential for the commodity cycle to shift towards non-ferrous metals, depending on changes in the market's liquidity environment.

Related News

Gold and Silver Prices Fluctuate… ETF Rally Stalled? - Financial NewsThe gold and silver rally that continued from last year has grown domestic related ETFs to a scale of 10 trillion won. Last year, gold and silver prices soared by 164.92% and 67.54%, respectively. Choi Ye-chan, an analyst at SangSangIn Securities, said, "The Fed announced in December last year that it is buying reserves at a monthly rate of $40 billion, effectively..."

Gold & Silver ETFs Surpass 10 Trillion KRW in Net Assets... Increased Volatility Expected - Financial NewsThe gold and silver rally that began last year has led domestic-related ETFs to grow to a scale of 10 trillion KRW. Over the past year, the prices of gold and silver have soared by 164.92% and 67.54%, respectively. Choi Yechang, a researcher at SangSangIn Securities, noted that 'The Federal Reserve announced last December a monthly 40 billion USD scale of reserve management purchases, effectively...'