Dividend Tax Reduction and Rise of Energy-themed ETFs

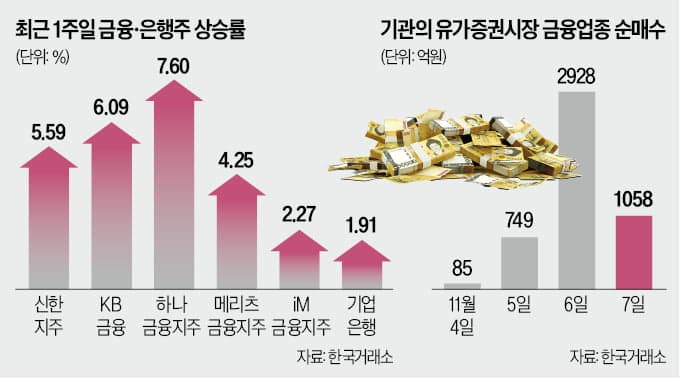

There is a notable increase in investor interest in high-dividend stocks as the government and ruling party consider lowering the top tax rate on dividend income. Financial and securities stocks, often recognized as high-dividend stocks, are experiencing a relative upward trend amidst market adjustments. This trend is underscored by the expected benefits from tax rate cuts, as evidenced by the rebound in major financial holding company stocks. In this context, funds are flowing into high-dividend ETFs such as 'PLUS High Dividend Stocks'.

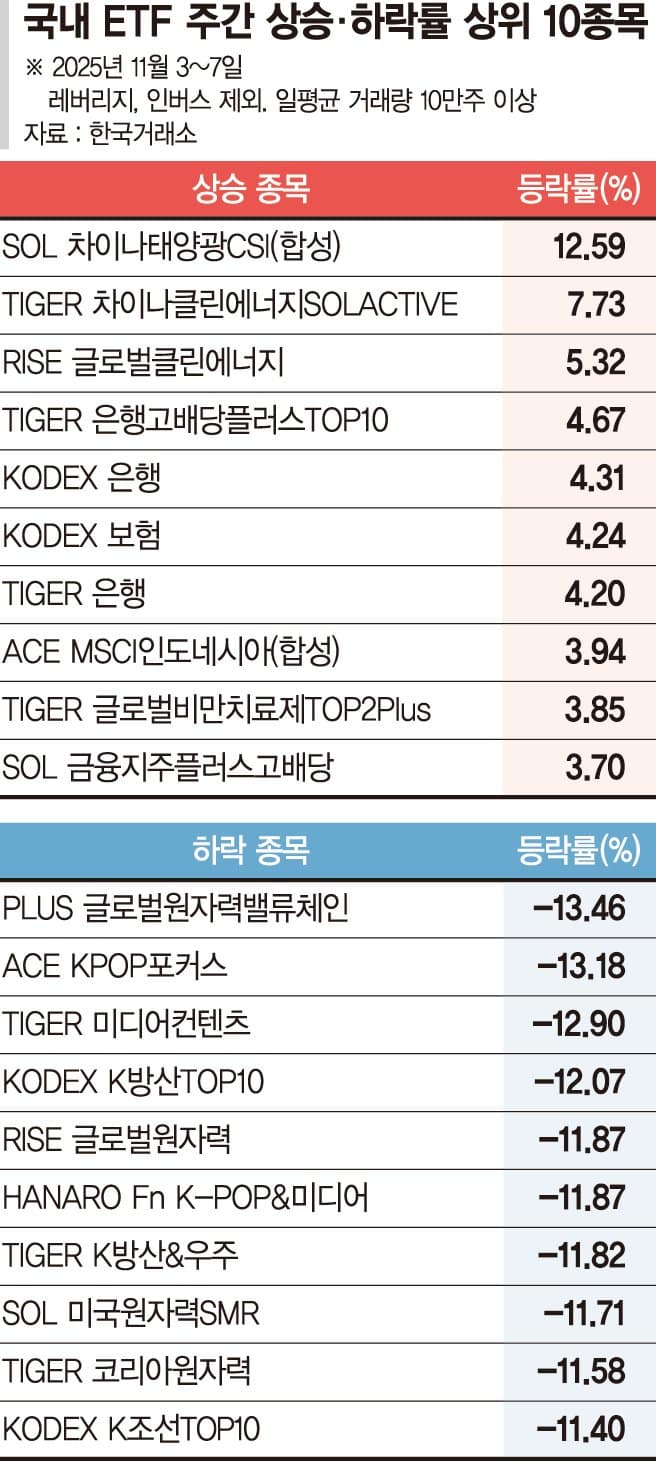

The domestic ETF market is seeing significant strength in clean energy themes. Driven by China's expansion of power infrastructure and the recovery of global eco-friendly policy momentum, 'SOL China Solar CSI' rose by 12.59%, recording the highest weekly return. Conversely, themes such as nuclear power, defense, and shipbuilding, which had shown strength earlier, are facing a downward trend due to recent profit-taking. Meanwhile, financial sector ETFs are on the rise due to expectations of recovering net interest margins and increased dividends.

Related ETF

Related News

‘Solar and Clean Energy’ Renewable Trends Strong... Defense and Shipbuilding in Adjustment Phase [ETF Square] - Financial NewsIn the domestic ETF market, the themes of solar power and clean energy collectively showed strength. ETFs in financial sectors such as banking and insurance also rose, driven by expectations of recovering net interest margins and expanded shareholder returns. On the other hand, themes like nuclear power, defense, and shipbuilding, which have been strong recently, underwent adjustments due to short-term profit-taking.

Related ETF

Is the 'Dividend Stock Time' coming, hidden by the AI hype? - Focus on Financial Stocks with Almost 50% Shareholder ReturnsIs the time for dividend stocks, hidden by the AI hype, arriving? Focus on financial stocks with nearly 50% shareholder returns. Expecting large inflows into high dividend ETFs. KB and Shinhan saw up to 7% rise in a week. Interest in SK, Mirae Asset Securities, and Meritz is growing.

Related ETF